According to a report, Australia’s top exchange might approve spot Bitcoin ETFs this year

According to Monochrome CEO Jeff Yew, Australia’s spot Bitcoin ETFs could attract $3 billion to $4 billion in inflows within the initial three years.

Australia’s largest stock exchange, the Australian Securities Exchange (ASX), may approve multiple spot Bitcoin exchange-traded funds (ETFs) by year-end. VanEck Australia and local ETF-focused fund manager BetaShares are reportedly set to receive approval for their Bitcoin ETF applications, following the lead of issuers in the United States and Hong Kong.

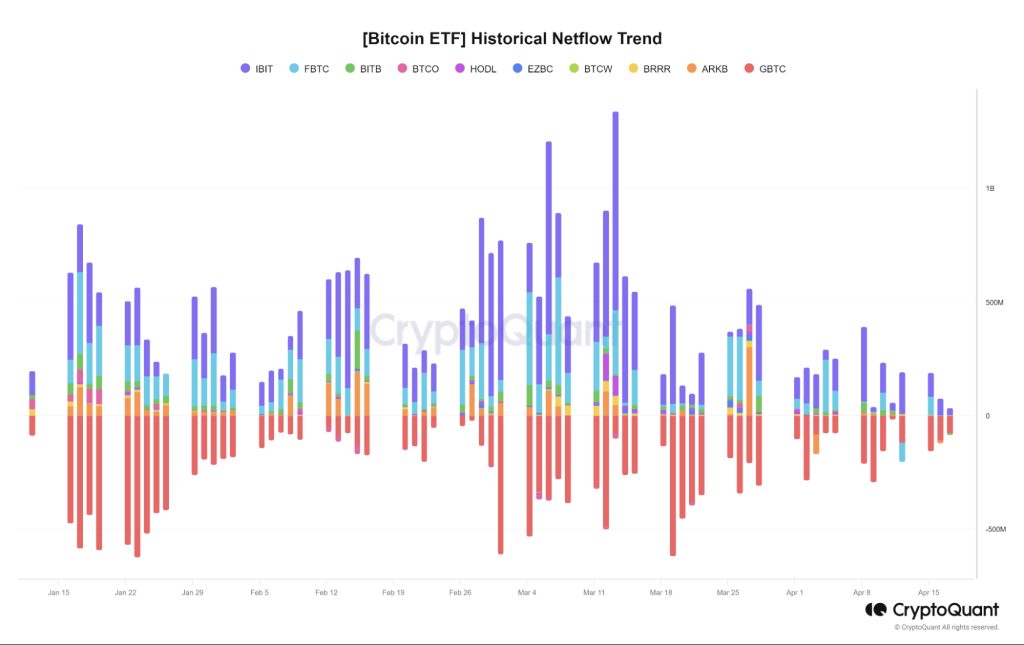

The surge in spot Bitcoin ETF applications follows approvals in the US, where eleven products have amassed $53 billion in assets under management (AUM), bolstering confidence in launching similar products in Australia, as noted by BetaShares’ head of digital, Justin Arzadon.

Monochrome’s CEO Jeff Yew anticipates significant demand for Australian spot Bitcoin ETFs, primarily from fund managers seeking Bitcoin exposure, self-managed super fund (SMSF) investors, and retail investors. SMSF investors currently hold direct Bitcoin exposure on crypto exchanges, which Yew deems risky and likened to a “ticking time bomb.” Bitcoin ETFs offer a regulated and safer alternative for such investors, allowing them to access digital assets more securely.

Monochrome initially applied for a spot Bitcoin ETF with the ASX in July last year but shifted to Cboe Australia due to a prolonged approval process. Yew cited Cboe’s more realistic timeframe and transparent listing framework as reasons for the switch, noting challenges the ASX faced with regulators and limited appetite for new products. Yew expects Cboe Australia to approve Monochrome’s application in the coming weeks.