Bitcoin Miner Marathon (MARA) Bags $130M In BTC Amid Strong Market Interest

Bitcoin Miner Marathon (MARA) Bags $130M In BTC Amid Strong Market Interest

Highlights

- Marathon (MARA) purchased $130 million in Bitcoin, sparking market optimism.

- Earlier this week, the firm made a similar purchase, showing strong confidence in the asset.

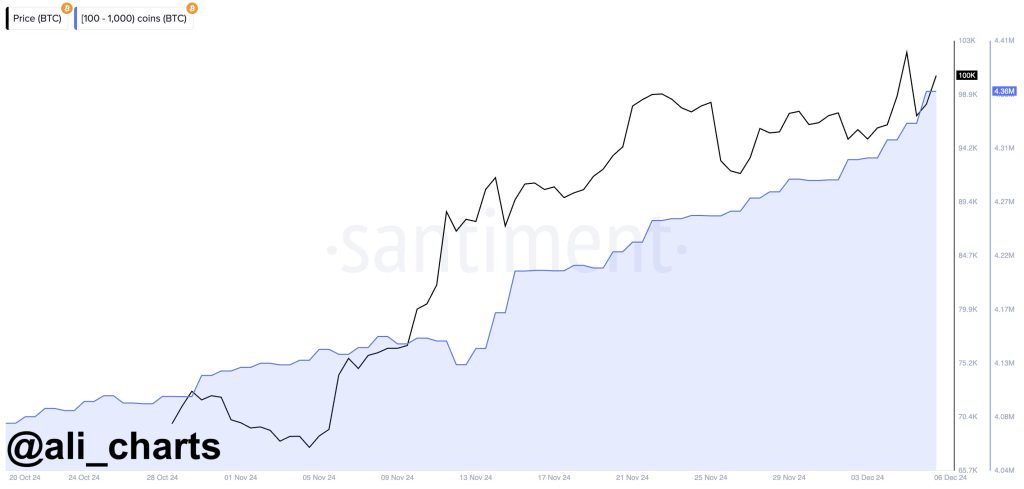

- Bitcoin whales are actively buying, signaling a potential rally ahead for the flagship cryptocurrency.

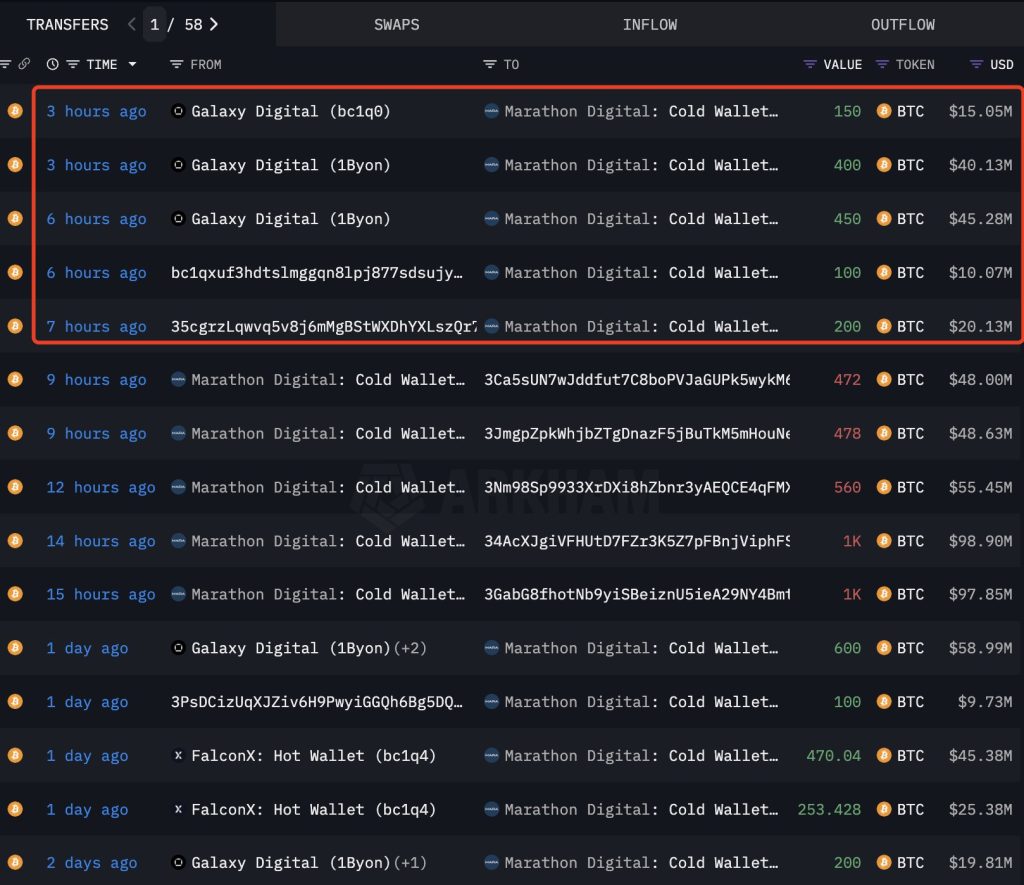

Marathon Digital (MARA), the leading Bitcoin miner, has once again attracted the attention of investors with its recent Bitcoin purchase. The firm has acquired 1,300 BTC, continuing its bullish stance on the cryptocurrency. This move comes shortly after Marathon made a similar acquisition of 1,423 BTC earlier in the week, further solidifying its commitment to increasing its Bitcoin holdings.

This surge in Bitcoin purchases follows Marathon’s announcement of successfully closing its second $850 million convertible note offering. By raising this substantial amount of capital, the firm is clearly positioning itself to further expand its Bitcoin buying strategy. The proceeds from this offering are expected to fuel additional investments in Bitcoin, reinforcing Marathon’s strong belief in the long-term value of the digital asset.

The timing of these acquisitions also highlights Marathon’s confidence in Bitcoin’s future price potential. As one of the largest miners in the space, Marathon’s purchases are closely watched by investors and industry analysts. The company’s strategy signals optimism for the cryptocurrency market, and its substantial investments may drive broader market sentiment.

Bitcoin’s recent price movements, alongside these large-scale purchases by significant miners like Marathon, indicate a potential rally ahead. Investors closely monitor the actions of Bitcoin “whales,” or large holders of the cryptocurrency, as their buying habits can heavily influence market trends. Marathon’s ongoing commitment to accumulating Bitcoin suggests it expects further upward momentum for the digital asset.

Marathon Digital’s continued Bitcoin purchases and strategic capital raises emphasize its aggressive approach to strengthening its position in the Bitcoin mining industry. As the firm remains bullish on Bitcoin, its actions are likely to inspire similar moves from other miners, potentially spurring a wave of positive momentum within the cryptocurrency market.

Bitcoin Miner Marathon (MARA) Maintains BTC Buying Spree

Top Wall Street players have recently shifted their focus toward the digital assets space, with massive buying activity highlighting this trend. Even with Bitcoin reaching $100K, institutional interest in the flagship cryptocurrency appears to remain strong.

Recent data shows that Bitcoin miner Marathon (MARA) has ramped up its Bitcoin buying strategy. According to Arkham data, MARA recently acquired 1,300 BTC, valued at approximately $130.66 million, just yesterday. This move has sparked optimism in the market, signaling continued confidence in Bitcoin.

Additionally, the firm made a similar purchase earlier this week, further capturing the attention of investors. Specifically, Marathon acquired 1,423 Bitcoin, worth approximately $139.5 million.

This significant buying activity follows the BTC miner’s announcement of successfully closing its second $850 million convertible note offering. According to the firm, the main goal of this move was to accelerate its Bitcoin acquisition strategy while also partially repurchasing existing notes set to mature in 2026.

Will Bitcoin Continue Its Rally?

Bitcoin’s price rose over 1% today, trading at $99,531, bouncing back from a 24-hour low of $97,629. The cryptocurrency also reached a 24-hour high of $102,039.88, reflecting strong market interest, especially amidst Marathon’s ongoing buying spree. However, trading volume dropped by 32%, totaling $93.57 billion during the same period.

According to CoinGlass data, BTC Futures Open Interest decreased by 0.5% to $61.25 billion within the last 24 hours, though a slight rebound has been noted in the short term. This suggests that investors are returning to the Bitcoin market after a brief pause, indicating renewed confidence.

Additionally, Bitcoin whales are joining institutions in their buying spree. Data from Ali Martinez reveals that whales have accumulated 20,000 BTC since yesterday, valued at approximately $2 billion, signaling strong confidence in the asset’s future. This trend suggests that Bitcoin could potentially break its all-time high of $103,900 set on December 5, reaching new record levels.