Crypto Market Today Feb 3: BTC Slumps To $91K, ETH & Meme Coins Crash 20%

Highlights

- BTC price crashes to as low as $91K, sparking concerns in the market.

- ETH and meme coins lose around 20% in value as the broader market faces a downturn.

- Investor uncertainty rises following Donald Trump’s announcement of new tariffs, fueling trade war speculations.

The global cryptocurrency market faced significant turmoil at the start of the week, largely triggered by new tariffs introduced by U.S. President Donald Trump. These tariffs caused broader market instability, which, in turn, impacted digital assets. Bitcoin (BTC) saw a sharp decline, plummeting to as low as the $91K mark on Monday, with altcoins also suffering similar price drops. The overall market downturn was exacerbated by a wave of liquidations, signaling a rising sense of uncertainty among investors as global trade tensions escalated.

Bitcoin’s dramatic plunge to $91K caught the attention of traders and analysts alike, as it marked a steep downturn following a period of relative stability. The leading cryptocurrency’s sharp drop mirrored the broader market’s reaction to Trump’s tariff announcement, which sent shockwaves through both traditional financial markets and the crypto sector. Altcoins followed suit, experiencing similar declines as market sentiment soured. Investors, already on edge due to the uncertainty surrounding trade policies, rushed to liquidate their positions in response to the volatility.

The liquidation trend was particularly striking, as it highlighted the growing fears within the cryptocurrency market. A significant number of traders were forced to exit positions as prices tanked, further contributing to the market’s downward spiral. This wave of sell-offs created a feedback loop, where falling prices led to more liquidations, amplifying the broader market slump. The crypto sector, which has historically been more volatile than traditional markets, found itself increasingly vulnerable to external shocks like the ongoing trade war.

As the week progressed, the broader financial market continued to react to Trump’s tariff measures, with many market participants closely monitoring any new developments. Analysts expressed concerns that the cryptocurrency market’s vulnerability to macroeconomic events, such as trade disputes, could lead to more volatility in the near term. While some experts remain optimistic about the long-term potential of digital currencies, the immediate future appears uncertain, especially if geopolitical tensions continue to escalate.

On February 3, as the dust began to settle from the week’s events, market participants were still processing the fallout. While Bitcoin’s price remained well below previous highs, the cryptocurrency market showed signs of stabilization. Traders and investors, however, remain cautious, with many awaiting further clarity on global trade dynamics and their impact on digital assets. As the cryptocurrency landscape adapts to the evolving global economic climate, the coming weeks could be pivotal in shaping the future trajectory of the market.

Crypto Market Slumps Amid Trade War Speculations With Trump’s New Tariffs

Following the introduction of new import tariffs by Donald Trump on Canada, Mexico, and China, global markets experienced significant shockwaves, with ongoing speculations about the potential for a trade war. In the midst of this turbulence, Bitcoin (BTC) and altcoins took a notable hit, reflecting the broader uncertainty. Ethereum (ETH) and popular meme coins were among the hardest hit, each losing roughly 20% of their value within the last 24 hours.

The impact on the cryptocurrency market was profound, with the global market cap dropping by nearly 9.5%, falling to $3.04 trillion over the past day. This sharp decline underscored the growing nervousness among investors, as the broader financial markets reacted to the tariffs and their potential long-term effects. The ongoing geopolitical tensions added to the volatility, driving many traders to reconsider their positions.

Amid the downturn, a surge in liquidations and sell-offs occurred, amplifying the market’s downward trajectory. Despite the overall decline in value, the total market volume saw a remarkable 182% increase, reaching $286.91 billion. This rise in volume indicated a surge in trading activity, as investors rushed to exit positions and respond to the rapid market shifts.

The combination of heightened market volatility and an increase in trading volume highlighted the degree to which uncertainty was influencing the cryptocurrency space. While the market was clearly under pressure, the sharp rise in volume suggested that many were trying to capitalize on the price fluctuations, even as the broader market remained unsettled.

As the global economic landscape continues to evolve amid these tensions, the cryptocurrency market is expected to remain highly sensitive to further developments. With the threat of an escalating trade war hanging in the balance, the coming days could offer critical insights into how cryptocurrencies, along with traditional markets, will respond to these mounting geopolitical challenges.

Bitcoin Price Today Loses 5% Amid Broader Crypto Market Trend

Amid the broader market turmoil, Bitcoin (BTC) saw a 5% dip, trading just above $94K at the time of writing. However, the cryptocurrency’s intraday price fluctuations were notable, with a low of $91,242.89 and a high of $100,485.89. Despite the decline, BTC’s dominance in the market increased by 2.76%, reaching 61.38%, suggesting that altcoins were taking a harder hit during the sell-off.

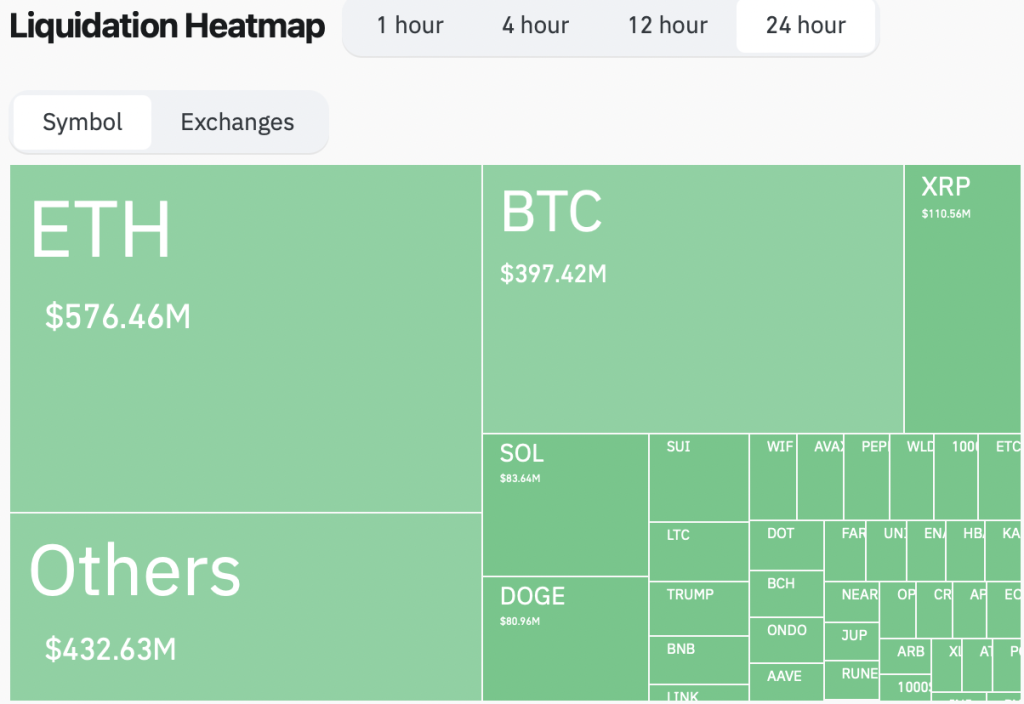

According to Coinglass data, Bitcoin experienced over $397 million in liquidations over the past 24 hours, which aligned closely with the price drop. The combination of falling prices and large-scale liquidations highlighted the market’s volatility and the strain investors were facing amid the ongoing uncertainty.

While Bitcoin’s price showed some resilience, the sharp price swings underscored the ongoing turbulence in the broader market. Despite the dip, the dominance increase indicated that Bitcoin remained the preferred asset in times of uncertainty, with investors flocking to the flagship cryptocurrency while altcoins suffered further losses.

The surge in liquidations also pointed to increased panic among traders, who were quick to exit positions in response to the volatility. This contributed to the overall market downturn, further exacerbating the instability in the crypto sector.

As the market continues to react to broader economic pressures, the coming days could provide additional insights into how Bitcoin and other cryptocurrencies will respond to the evolving situation. However, with liquidations rising and Bitcoin’s dominance increasing, it’s clear that investor sentiment remains heavily influenced by market volatility.

Ethereum Price Dips Nearly 20%

Ethereum (ETH) experienced a significant intraday drop of 18%, currently trading at $2,551. The coin saw a low of $2,159.28 and a high of $3,137.25 within the past 24 hours, reflecting the intense volatility in the market. Like Bitcoin, Ethereum followed the broader market trend, experiencing a sharp decline as sell-offs surged across the board.

A recent post by Lookonchain on X revealed an intriguing development: an ETH whale, dormant for over six years, reactivated its account just before the crash and sold off all its holdings. This move added to the mounting uncertainty and contributed to the broader market’s downward spiral.

Coinglass data further illustrated the scale of the downturn, with over $576 million worth of Ethereum liquidations taking place within the last 24 hours. The rise in liquidations highlights the growing panic among traders, who were quickly exiting their positions as prices continued to fall.

The combination of large-scale sell-offs and whale activity emphasized the market’s fragile state. As Ethereum follows the broader market’s plunge, it’s clear that investor sentiment is deeply shaken, with volatility continuing to dominate the crypto landscape.

With sell-offs escalating and liquidations on the rise, the outlook for Ethereum remains uncertain. The actions of major players, combined with the broader economic pressures, suggest that the coming days could see further turbulence for the second-largest cryptocurrency by market cap.

XRP Price Falls Below $2.5

XRP saw a dramatic decline of over 20% intraday, now trading at $2.26. The coin’s price fluctuated between a low of $1.95 and a high of $2.92 within the past 24 hours, reflecting the intense market volatility. XRP’s downturn followed the broader trend in the crypto market, as sell-offs continued to accelerate across digital assets.

In line with the price drop, XRP experienced $110.5 million worth of liquidations over the past day. This surge in liquidations mirrors the broader trend of heightened uncertainty and panic selling seen throughout the cryptocurrency market.

As the market continues to face turbulence, XRP’s significant price drop highlights the ongoing instability in the sector. The increase in liquidations further underscores the growing pressure on traders and investors, who are scrambling to exit positions amid the downturn.

The continued volatility in XRP, along with the broader market, suggests that investor sentiment remains cautious, with many anticipating further fluctuations in the coming days. The trend of increasing liquidations also points to the potential for more instability if market conditions don’t stabilize soon.

Solana Price Slips 6%

Solana (SOL) saw a nearly 6% pullback in the past 24 hours, bringing its price to $197.46. During this period, the coin’s price fluctuated between a low of $180.41 and a high of $215.54, reflecting significant intraday volatility.

In line with the broader market trend, SOL experienced $83 million worth of liquidations over the past day, according to Coinglass data. This surge in liquidations highlights the mounting pressure on traders as market uncertainty continues to grow.

The pullback in SOL’s price, along with the rise in liquidations, underscores the heightened volatility in the cryptocurrency market. As sell-offs intensify, investor sentiment appears increasingly fragile, with many cautious about further price movements.

As Solana’s price remains susceptible to broader market shifts, the coming days may offer more clarity on whether the cryptocurrency can stabilize or if additional sell-offs will occur. With liquidations rising, the market’s volatility shows no signs of easing just yet.

Meme Crypto Market Slumps In Sync

Dogecoin (DOGE) saw a sharp 22% drop in the past 24 hours, bringing its price down to $0.2326. Similarly, Shiba Inu (SHIB) plunged 21% intraday, currently sitting at $0.00001355. PEPE also took a hit, crashing 26% to $0.000008983.

Across the board, the meme coin market is following the broader bearish trend, reflecting the overall downturn in the cryptocurrency sector. The significant price drops in these popular coins highlight the intense sell-off sweeping through the market, as investor sentiment remains shaky.

The steep declines in DOGE, SHIB, and PEPE mirror the broader market’s volatility, with traders pulling back in response to rising uncertainty. As meme coins experience heavy losses, they are largely tracking the same pattern of downturn seen in other major cryptocurrencies.

With the market facing increasing pressure, the outlook for meme coins appears similarly bleak, unless market conditions shift in the near future. The trend of sharp declines and heightened volatility suggests that the meme coin space will continue to feel the effects of broader market movements.

As the market stabilizes, the future of meme coins will depend on how quickly investor confidence returns and whether broader crypto sentiment improves. Until then, the bearish momentum continues to shape the meme coin landscape.

As noted earlier, the market’s downturn is closely tied to growing investor uncertainty following Trump’s new tariffs. As a result, the cryptocurrency sector has seen over $2 billion in liquidations over the past 24 hours, according to the Coinglass liquidation heat map. With the market in flux, analysts are divided—some are hopeful for a potential recovery, while others maintain a more bearish outlook on future price movements.