Standard Chartered Predicts Bitcoin Will Reach $135K in Q3, $200K by Year’s End

Highlights

- Bitcoin may reach $135K in Q3 and $200K in Q4, according to a forecast by Standard Chartered.

- Growing institutional adoption is expected to be a key driver behind the potential price surge.

- BTC price action may deviate from traditional halving cycle patterns, signaling a shift in market dynamics.

Standard Chartered Predicts Bitcoin to Hit $135K in Q3 and $200K by Year-End Amid Rising Institutional Demand

Global financial heavyweight Standard Chartered is making headlines once again with an assertive forecast for Bitcoin’s performance in the second half of 2025. According to the bank’s head of digital asset research, Geoff Kendrick, Bitcoin is on track to reach $135,000 by the end of Q3 and may surge to $200,000 by December.

The bullish outlook was highlighted in a recent update, further reinforced by a post from crypto journalist Wu Blockchain, who shared the bank’s predictions on X (formerly Twitter). This continues a series of optimistic calls by Standard Chartered, which has consistently championed Bitcoin’s long-term potential.

Institutional Adoption Drives Optimism

The foundation of the bank’s forecast lies in the increasing institutional adoption of cryptocurrencies, particularly Bitcoin. Kendrick emphasized that market dynamics have evolved significantly, with exchange-traded funds (ETFs) and corporate treasury allocations providing strong upward momentum for BTC.

Over the past week alone, nine corporate entities reportedly acquired 6,000 BTC, a signal that big-money players are increasingly treating Bitcoin as a strategic asset. Kendrick stated, “We expect prices to resume their uptrend, supported by continued strong ETF and Bitcoin treasury buying.”

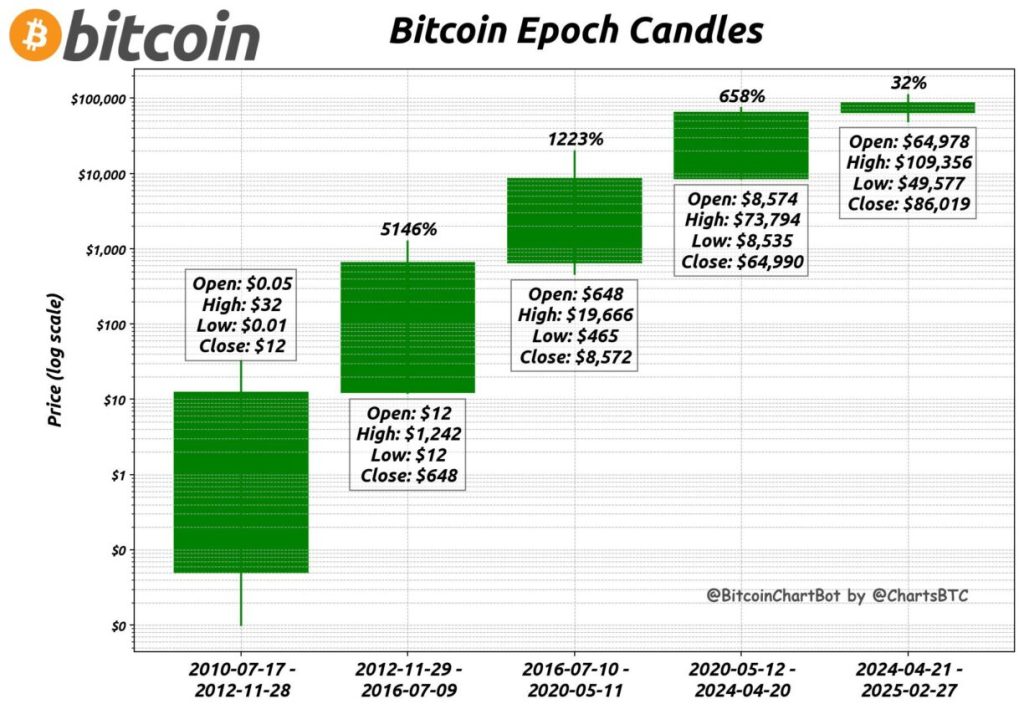

Bitcoin Price Action May Break from Halving Cycle Norms

Kendrick also touched on the evolving impact of Bitcoin’s halving cycles—the four-yearly event that reduces mining rewards by 50%. Traditionally, Bitcoin prices have spiked shortly after a halving but tend to dip roughly 18 months later.

However, Kendrick believes 2025 could mark a break from this pattern. Based on the bank’s analysis, increased capital inflow and shifting investor behavior may shield Bitcoin from the typical post-halving decline. “Thanks to increased investor flows,” he noted, “we believe BTC has moved beyond the previous dynamic whereby prices fell 18 months after a halving.”

BTC Market Snapshot

As of the latest data, Bitcoin is trading at $107,468, up 0.8% over the past 24 hours. Weekly and monthly movements remain modest, with gains of 0.21% and 0.25% respectively.

While some market watchers remain cautious amid ongoing volatility, Standard Chartered’s stance signals growing confidence in Bitcoin’s resilience and maturity as an asset class.