Bitcoin price peels back from its weekly high, but BTC derivatives markets look good

Bitcoin’s price is facing downward pressure from broader economic and stock market trends, yet futures market data indicates that traders remain optimistic. Since the rally on October 29, which brought Bitcoin close to its all-time high, its price momentum has slowed. Despite this, the derivatives market reflects continued confidence among traders regarding a potential price recovery.

Analysis of Bitcoin’s futures and options markets reveals that traders are holding their positions without resorting to excessive leverage. This cautious approach is vital for achieving a sustainable rise toward new all-time highs. However, it is important to pinpoint the reasons behind Bitcoin’s price drop below $69,000 on November 1.

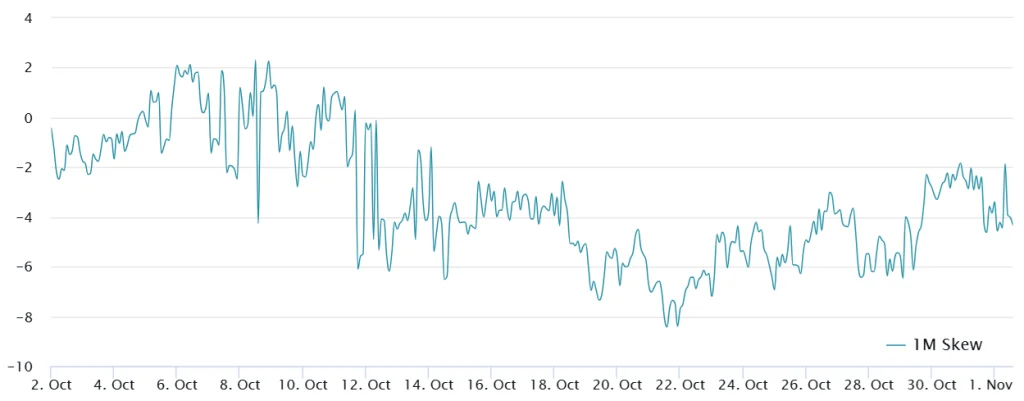

When traders expect a decline in Bitcoin’s price, the 25% delta skew metric typically rises above 7%. This trend indicates that the pricing of put (sell) options reflects heightened demand, as traders seek to hedge against potential losses. Understanding these dynamics helps clarify the sentiment in the market.

The futures market serves as a barometer for traders’ attitudes, showing that many still expect a rebound in Bitcoin’s value. Even with current pressures, the overall sentiment remains bullish, suggesting that traders anticipate a turnaround despite recent volatility.

The current state of the economy and fluctuations in the stock market contribute to the uncertainty surrounding Bitcoin. However, the willingness of traders to hold their positions without excessive risk demonstrates their belief in Bitcoin’s long-term potential.

Monitoring the activity in the derivatives market is essential for assessing future price movements. The lack of over-leverage among traders supports the idea that they are positioning themselves for future gains rather than engaging in speculative bets that could lead to larger price swings.

As Bitcoin navigates these challenges, traders are likely to continue focusing on market signals and sentiment. The balance between caution and optimism will play a crucial role in shaping Bitcoin’s trajectory in the coming weeks.

In summary, while external economic factors have created headwinds for Bitcoin’s price, the resilience of traders in the futures market indicates a persistent belief in a recovery. Understanding the interplay between these elements will be key to forecasting Bitcoin’s future price movements.

Bitcoin derivatives look stable despite the BTC price pullback

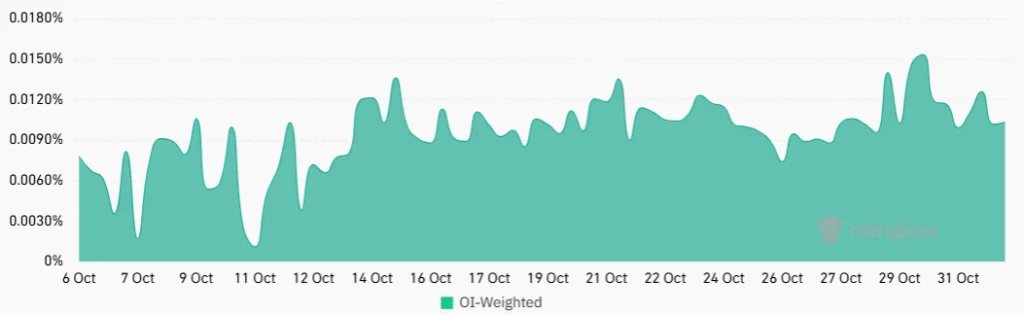

To determine if Bitcoin traders’ sentiment has weakened following the recent downturn, analyzing the funding rate of perpetual contracts (inverse swaps) is essential. A neutral funding rate, which incurs no cost for bullish leverage, indicates a lack of strong conviction among traders. Conversely, rates above 2.1% per month reflect excessive optimism.

On November 1, the funding rate remained stable, with a negligible impact on leverage demand. The rate stood at 0.01% every eight hours, translating to approximately 0.9% per month, which is generally considered neutral. This suggests that traders do not exhibit a strong desire to increase leverage, pointing to a cautious yet balanced market sentiment.

The absence of significant leverage during Bitcoin’s rally from $67,000 to $73,500 between October 27 and October 29 further reinforces this perspective. This lack of leverage indicates that traders are not overly speculative, which bodes well for a healthy market trend.

Overall, the data from Bitcoin’s derivatives markets supports the notion of a sustained bull market. The current conditions suggest that traders are positioning themselves for potential future gains rather than engaging in risky behavior that could destabilize the market.

As Bitcoin continues to navigate market fluctuations, the funding rates serve as a critical gauge for assessing trader sentiment. The neutral rates observed indicate that traders are adopting a wait-and-see approach, which can help stabilize prices in the face of uncertainty.

In summary, while the market has experienced a downturn, the analysis of funding rates reveals a measured sentiment among Bitcoin traders. The absence of excessive leverage suggests a solid foundation for potential future rallies.

The overall outlook remains cautiously optimistic, with Bitcoin’s derivatives markets hinting at opportunities for further growth. Understanding these dynamics will be crucial for traders as they navigate the evolving landscape of the cryptocurrency market.

Multiple factors impact investor sentiment

From a trading perspective, securing profits ahead of significant political and economic events has become crucial. Bitcoin’s recovery to $71,000 on November 1 closely correlates with movements in the S&P 500 index, indicating that both markets respond to similar macroeconomic indicators.

In the short term, during periods of recession risk, traders typically shift their focus to cash positions and Treasury bills for safety. This behavior helps explain the recent declines in both the stock market and Bitcoin, particularly following Intel’s report of a 6% quarterly revenue drop compared to the previous year.

Recent financial disclosures from major tech companies like Microsoft and Meta highlight an uptick in AI investments, but they have also tempered expectations for earnings growth. This news emerged after Super Micro Computer (SMCI) shares plummeted 44% over three days following the unexpected resignation of its auditor, EY.

The market sentiment shifted on November 1 when the US Bureau of Labor Statistics reported a payroll growth of just 12,000 for October, significantly below the anticipated 100,000. This disappointing figure contributed to a sense of unease among traders and investors.

Moreover, US wages increased by 0.4% from the previous month, raising concerns about inflation. Despite these inflation fears, market analysts using the CME FedWatch tool project a 0.25% interest rate cut by the US Federal Reserve on November 7, suggesting a potential easing of monetary policy.

Upcoming events, including the US presidential elections on November 5 and the Federal Open Market Committee (FOMC) meeting, are particularly important to monitor. The political drive to stimulate the economy often results in a depreciation of the US dollar, which can positively influence Bitcoin’s price in the medium term.

Traders are keenly aware of these macroeconomic dynamics as they make decisions. The interplay between political developments and market reactions will play a significant role in shaping the trading landscape for Bitcoin and other assets.

As the market anticipates the outcomes of these key events, traders are likely to remain cautious, balancing their positions between risk and opportunity. The potential for volatility remains high, particularly given the interconnectedness of economic indicators and market sentiment.

In summary, the relationship between Bitcoin and traditional markets underscores the importance of monitoring economic data and political events. As traders navigate this complex landscape, understanding these correlations will be essential for making informed decisions.

Ultimately, the outlook for Bitcoin will depend on how these factors unfold in the coming days. The interplay between economic reports, political developments, and market sentiment will dictate the direction of Bitcoin’s price in the near future.