Bitcoin Price Prediction: Post-Powell Volatility Points to Potential Q4 Surge

Bitcoin Price Prediction: Post-Powell Surge Sets the Stage for Potential Q4 Rally

Bitcoin Surges Past $116K After Powell’s Remarks, Fueling Q4 Optimism

Bitcoin’s price has surged past the $116,000 mark following Federal Reserve Chair Jerome Powell’s remarks at Jackson Hole, sparking renewed optimism for a strong Q4 performance. The breakout has echoes of previous post-speech rallies, suggesting history could repeat itself. While September is traditionally volatile for crypto markets, current technical structures still favor upward momentum. As a result, market participants are closely watching current price levels as a possible launchpad for the next major move.

Bitcoin’s Price Pattern Mirrors Past Post-Powell Rallies

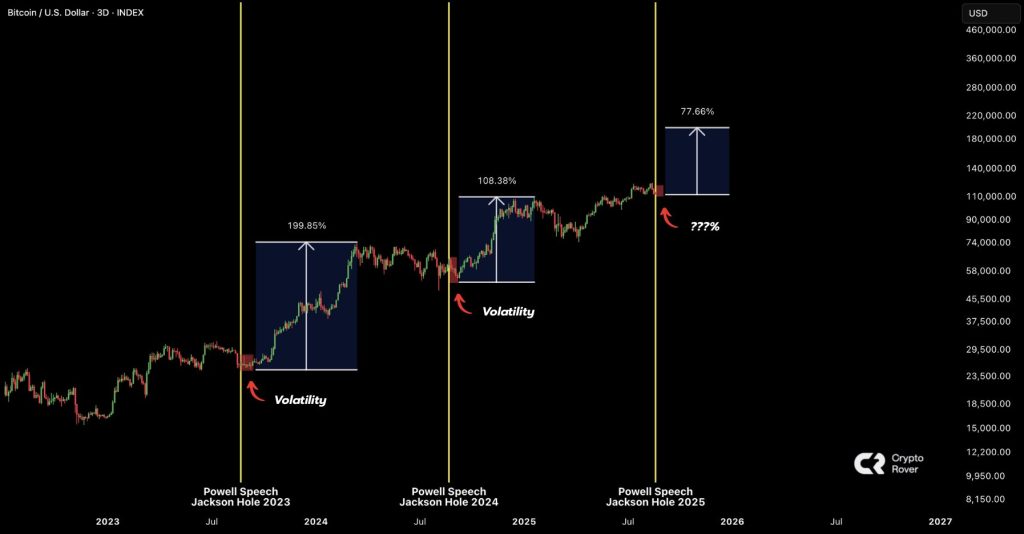

A crypto analyst on X (formerly Twitter) pointed out that Bitcoin often follows a similar trajectory after Powell’s Jackson Hole appearances—typically marked by short-term volatility in September, followed by substantial Q4 rallies.

In 2023, Bitcoin surged nearly 200% in the months after the speech. A year later, in 2024, the asset climbed over 100%. This year’s pattern is again aligning, with analysts predicting a potential gain of over 77% if the trend holds.

This recurring behavior is boosting confidence among traders and long-term holders alike. As Bitcoin consistently posts strong performance following Powell’s dovish turns, the setup is strengthening bullish sentiment heading into 2025.

Technical Outlook: Bitcoin Breaks Key Levels with Bullish Structure Intact

On the daily chart, Bitcoin bounced sharply from the $112,000 support and quickly cleared the $116,000 barrier after Powell’s comments. This move confirmed the neckline of an inverse head-and-shoulders pattern, now acting as a strong support base.

Currently, Bitcoin is consolidating between $112,000 and $118,000, forming an accumulation zone. Fibonacci extension levels point to possible targets at $123,000 and $126,500 in the short term.

Additionally, the 50-day Exponential Moving Average (EMA) has provided firm support around $114,800—highlighting sustained buyer interest. If Bitcoin manages to break above the $118,000 resistance level with strong volume, the next leg higher could begin, confirming a continued bullish trend.

Powell’s Dovish Shift Sparks Renewed Risk Appetite in Crypto Markets

During his Jackson Hole speech, Jerome Powell highlighted growing risks in the labor market and hinted at a potential rate cut as early as September. He emphasized that employment growth has stalled and that payroll figures have fallen short of expectations—casting doubt on the health of the job market.

Importantly, Powell acknowledged that downside risks to economic growth now outweigh inflationary concerns, marking a subtle shift from the Fed’s previously hawkish stance. He also downplayed the inflationary impact of tariffs, further weakening the argument for continued tight policy.

Markets responded swiftly, with Bitcoin breaking above $116,000 as traders priced in a more accommodative monetary policy outlook. Historically, similar dovish pivots at Jackson Hole have preceded large rallies in Bitcoin and broader crypto markets. This year appears to be no different.

Conclusion: Bitcoin Builds Momentum as Macro and Technical Signals Align

Bitcoin has once again demonstrated its resilience, bouncing from key support levels and reacting positively to a shift in central bank tone. Historical patterns suggest that Powell’s Jackson Hole remarks often precede bullish quarters for BTC—and the current setup points to a similar outcome.

With solid technical support above $112,000 and growing anticipation of rate cuts, the macro environment and chart structure are both signaling further upside. As a result, the Bitcoin price forecast remains bullish heading into the final quarter of the year.