Bitcoin Price Will Hit $123K if These 4 Conditions Are Met

Highlights

- Bitcoin price needs to meet four conditions to surpass the $105K hurdle and reach a new all-time high (ATH) at $123K.

- Key conditions to monitor:

- Historical returns

- Whale activity

- Institutional accumulation of BTC

- Overcoming key price hurdles

- A break above the $105K level could pave the way for Bitcoin to set a new ATH at $123K, based on Fibonacci extension levels.

Bitcoin is currently trading at $104,215.0, down 1.22% for the day. This decline has reversed about half of the gains seen following the Federal Open Market Committee (FOMC) meeting, marking a significant pullback. The market appears to be facing downward pressure as the typical month-end volatility starts to take hold, suggesting that further declines may be in the cards in the short term.

Despite the recent setback, the long-term outlook for Bitcoin remains bullish. Historical trends show that February tends to be a positive month for the cryptocurrency, with many analysts predicting a continuation of upward momentum. The recent pullback, while notable, is being viewed by some as a temporary correction within a larger growth pattern.

The big question now is whether Bitcoin can break through its current resistance and reach new highs, potentially surpassing the $123,000 mark. While the road to that milestone may not be smooth, market trends, investor sentiment, and the overall trajectory of digital assets suggest that the $123K target remains a realistic goal for Bitcoin in the near future.

Will Bitcoin Price Hit $123K?

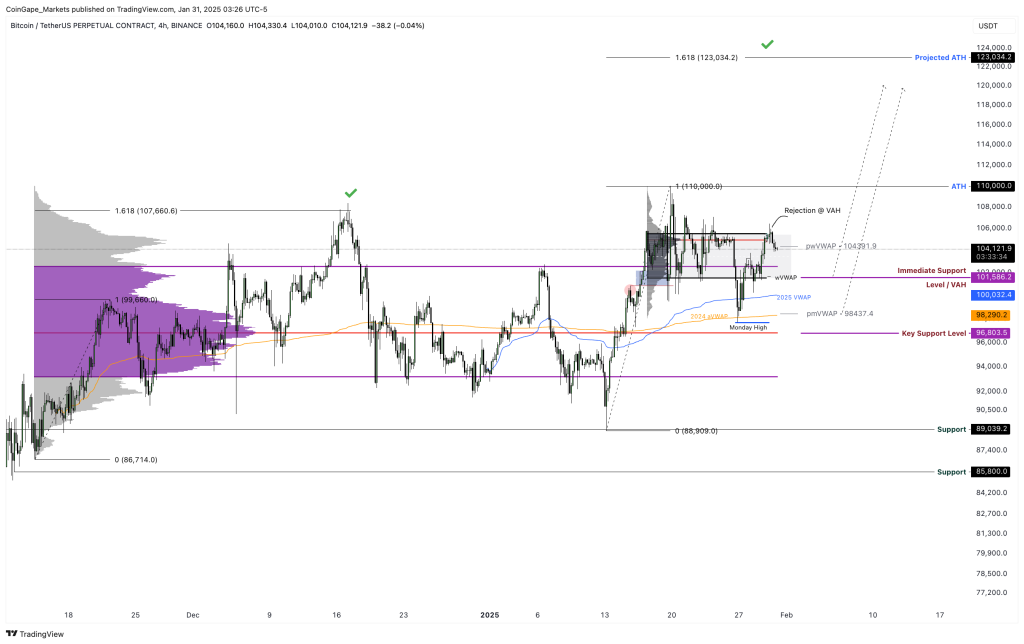

Since mid-November 2024, Bitcoin has been trading within a sideways range, failing to break out with significant momentum despite several attempts. Over the past 78 days of this consolidation phase, the cryptocurrency has still managed to establish a series of new highs. The most recent all-time high (ATH) occurred on January 20, reaching $110,000.

Between November 14 and 22, 2024, Bitcoin surged nearly 14%, climbing to $99,660. Analyzing this move with the Fibonacci tool reveals that the next ATH was formed at the 161.8% Fibonacci extension level. Given this pattern, it’s reasonable to expect that the next potential ATH could be around $123,000, following a similar trend in price behavior.

As Bitcoin continues to consolidate, market watchers are keeping an eye on these Fibonacci levels as a key indicator of future price movements. If the previous pattern holds true, the $123K mark could be within reach, especially if BTC gains the necessary momentum to break out of its current range.

4 Conditions Could That Can Propel BTC to $123K

For Bitcoin to hit a new all-time high of $123K or higher, there are four key factors that need to fall into place.

First, Bitcoin must break through the $105.5K resistance level, which has proven to be a barrier, halting the post-FOMC rally. Overcoming this price point will be crucial for setting the stage for new highs.

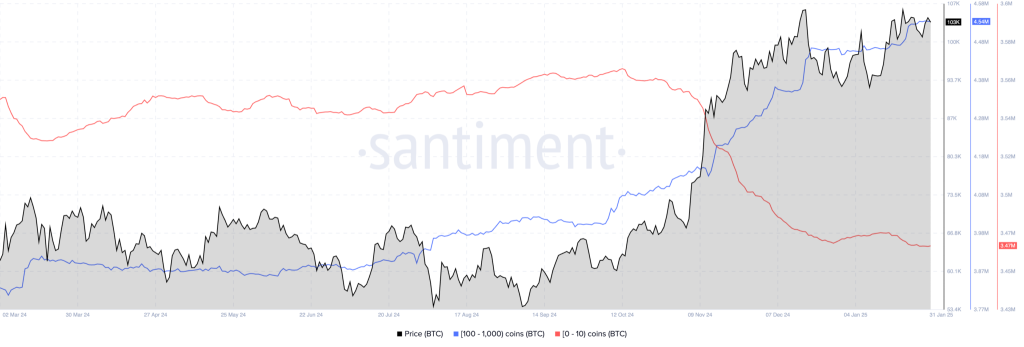

Second, a divergence between retail and institutional investors is signaling potential for further gains. According to data from Santiment, the number of wallets holding between 0 and 10 BTC (typically retail investors) has been decreasing, while larger wallets holding between 100 and 1000 BTC have been steadily accumulating. Retail investors often react to short-term fluctuations and tend to sell off before a major price surge, whereas the accumulation by larger players suggests confidence in the long-term bullish trend, making a new ATH more likely.

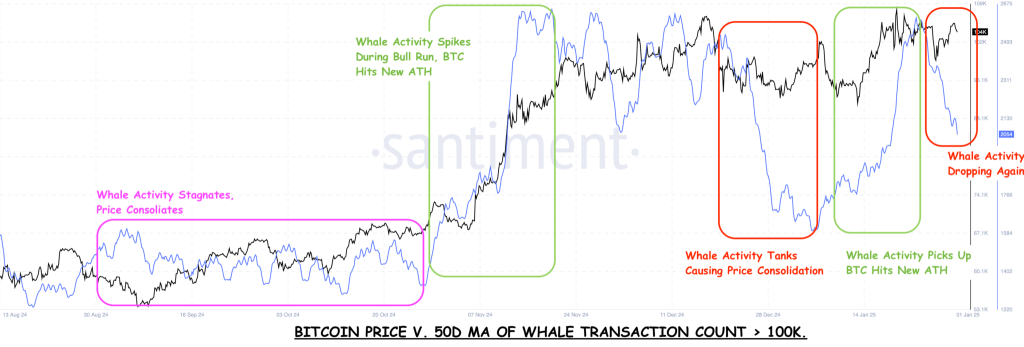

Whale transaction activity, specifically transfers worth $100K or more, has declined since January 24. As shown in the image, spikes in this metric have historically been a signal of rising prices. In contrast, the recent drop suggests that whales may be losing interest, which could lead to a period of consolidation or a potential price pullback. However, if this trend reverses and whale activity picks up again, it would significantly increase the likelihood of Bitcoin reaching new all-time highs.

Historically, Bitcoin’s average monthly return for January is about 4%. However, February tends to be much stronger, with an average return of around 15.66%. Given this pattern, the likelihood of Bitcoin reaching a new all-time high in February, possibly hitting $123K, is quite high.

Of the four key conditions mentioned, two have already been met. Bitcoin must still overcome the $105K resistance level, and whale transactions over $100K need to reverse their decline and spike again. Once all four conditions are in place, Bitcoin could be poised to set a new all-time high at $123K.

Key Levels to Watch as BTC Price Drops

As January comes to a close, investors can expect continued volatility. Since hitting a high of $106,450 on Thursday, Bitcoin has dropped by 2.04%, and this short-term downtrend is likely to persist around the New York market open.

In this scenario, there are several key demand levels to monitor: $101.5K, $100K, $98.2K, and $96.8K. The $101.5K level aligns with the upper limit of the 78-day range and this week’s VWAP. Below that, the 2025 VWAP at $100K and the 78-day consolidation VWAP at $98.2K are the next major support zones. The most crucial support level to watch is $96.8K, which represents the highest volume traded over the past 78 days.

These support levels could present good opportunities to accumulate Bitcoin at a discount. A bounce off any of these levels might pave the way for a new all-time high. On the resistance side, the key level to focus on is $105K. Breaking through this level could propel Bitcoin toward the current ATH of $110K and set the stage for a new high around $123K.