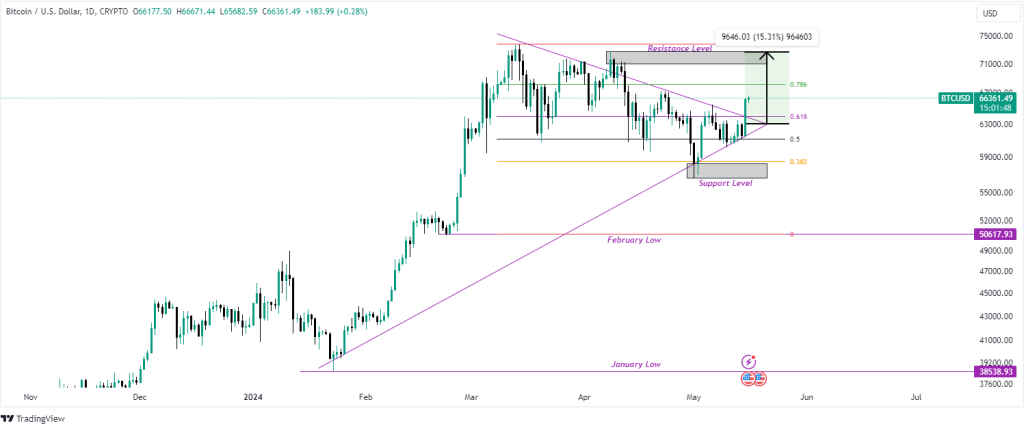

Bitcoin Surpasses $66K Threshold After CPI Data, Targets New Highs

Bitcoin’s price surged by an additional 6% on Thursday, crossing the $66,000 mark for the first time since March. As of the latest update, it sits at $66,225.85, boasting a market capitalization of $1.295 trillion. Concurrently, trading volume spiked by 76.00%, totaling $42.575 billion.

This notable uptick follows the recent release of U.S. Consumer Price Index (CPI) data on Wednesday. Bitcoin has notably breached the $64,000 resistance level, potentially paving the way for further climbs to unprecedented highs.

Market analysts are signaling a potential end to the recent downtrend. Rekt Capital, a cryptocurrency research firm, suggests that the breakout indicates the possible conclusion of Bitcoin’s downtrend, often preceded by pullbacks before substantial gains.

Moreover, Bitcoin is demonstrating signs of decreasing sell-side pressure, showing stability around the $60,000 support level. Maintaining this support is pivotal for the continuation of the upward trajectory.

Renowned market analyst Peter Brandt echoes this optimism, foreseeing Bitcoin’s journey towards new highs. However, Brandt emphasizes the necessity for Bitcoin to decisively surpass the $67,000 threshold, accompanied by robust bullish activity.

Bitcoin’s trajectory indicates a promising ascent as it breaks the symmetrical triangle on the daily chart. This bullish breakout could propel BTC towards the $70,000 mark if current sentiments persist. Conversely, a shift to bearish sentiments might see Bitcoin seeking support at $58,000.

The Moving Average Convergence Divergence (MACD) indicator further reinforces a positive outlook with its upward trend, indicating sustained bullish sentiment. Presently nearing the zero threshold at -121.04, the MACD line suggests potential continued bullish momentum in the short term.

Supporting the bullish momentum, the MACD histogram displays widening green bars above the zero line, indicating strengthening bullish momentum and sustained buyer interest, potentially leading to further price appreciation.

The Relative Strength Index (RSI) mirrors this positive sentiment, climbing sharply to 57.91. Positioned well above the signal line and avoiding overbought territory, the RSI suggests significant room for growth before the market becomes overheated.

Disclaimer: The content provided in this article is solely for informational and educational purposes.

Crypto News Online Hub assumes no liability for any losses arising from the use of information,

products, or services referenced herein. Readers are urged to proceed with caution and conduct

thorough research before making any decisions related to the subject matter discussed.