Breaking: BlackRock Bitcoin ETF Records Largest Outflow Since Launch

Summary

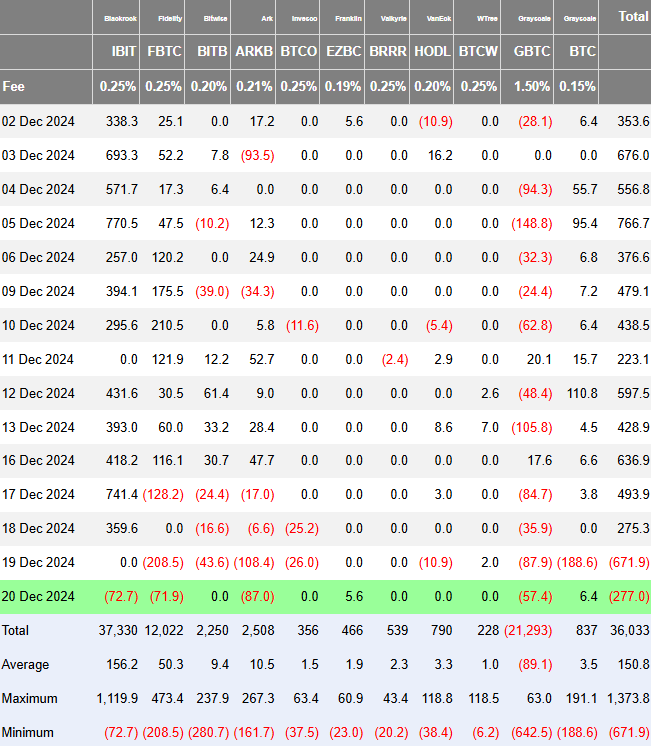

- BlackRock Bitcoin ETF recorded its highest outflow since its launch on December 20.

- Fidelity’s FBTC also experienced its largest outflow on December 20, amid the broader crypto market crash.

- US Spot Bitcoin ETFs ended their 16-day inflow streak on December 18.

The US Spot Bitcoin ETF has ended its 16-day inflow streak this week, following a massive pullback in the crypto market. This shift marks a notable change in market sentiment, as investors reassess their positions amid the downturn. The end of the inflow streak highlights growing caution among investors, who are becoming more cautious in their approach to the volatile cryptocurrency market.

In the same period, BlackRock’s Bitcoin ETF (IBIT) recorded its highest outflow since its launch, further fueling concerns among market participants. This significant outflow indicates that investors are beginning to pull back from their exposure to Bitcoin, reflecting the broader risk aversion in the market. The high outflow from BlackRock’s ETF signals that even well-established investment vehicles are not immune to the changing dynamics of the crypto market.

Similarly, Fidelity’s FBTC also experienced its largest outflow earlier this week, mirroring the general sentiment in the market. The decline in Fidelity’s Bitcoin ETF suggests that institutional investors are starting to scale back their riskier bets, particularly in the wake of the recent market pullback. This pattern of outflows from multiple Bitcoin ETFs underscores a broader trend of caution among both institutional and retail investors.

The pullback in the crypto market, coupled with these significant outflows, reflects a shift in investor behavior. As the market faces increased uncertainty, many investors are looking for safer alternatives, moving away from high-risk assets like Bitcoin. The outflows from major Bitcoin ETFs are a clear indication that risk appetite is waning, which could have lasting implications for the market’s performance.

The end of the US Spot Bitcoin ETF’s 16-day inflow streak, combined with the outflows from BlackRock and Fidelity’s Bitcoin ETFs, highlights the increasing caution in the crypto market. As investors become more risk-averse, the future trajectory of Bitcoin and other cryptocurrencies may face more challenges. The market will likely continue to experience volatility, with investors closely watching the evolving trends in institutional and retail participation.

BlackRock Bitcoin ETF Records Largest Outflow Ever

The recent crypto market crash has significantly impacted investor sentiment, as seen in the sharp pullback of digital assets. Amid the Bitcoin downturn, the US Spot Bitcoin ETFs recorded outflows this week, ending their 16-day inflow streak on December 18.

BlackRock Bitcoin ETF (IBIT) saw its largest outflow of $72.7 million on Friday, December 20, according to Farside Investors data. This followed a major outflow from Fidelity’s FBTC, which experienced its largest outflow of $208.5 million a day earlier. This marked the biggest withdrawal since the launch of these investment products in the US in January 2024.

In total, the US Spot Bitcoin ETFs experienced a combined outflow of $671.9 million on December 19, followed by an additional $277 million on December 20. These significant outflows reflect a shift in investor behavior amid the ongoing market downturn, with many pulling back from their Bitcoin positions in response to the market volatility.

The outflows from major Bitcoin ETFs are indicative of growing caution among institutional investors. As the market continues to face uncertainty, investors appear to be re-evaluating their exposure to riskier assets like Bitcoin, leading to the substantial withdrawals.

Overall, the recent outflows from the US Spot Bitcoin ETFs highlight the broader market shift as investors become more risk-averse following the crypto market crash. The continued volatility is likely to influence future investment decisions in the crypto space, especially among institutional players.

Meanwhile, Bitcoin has experienced a strong rally this year, particularly following Donald Trump’s election win in November. The cryptocurrency reached a new all-time high of $108K earlier this month, driven by rising optimism surrounding the US Bitcoin Strategic Reserve. In addition, other global leaders, including those in Europe, have indicated the possibility of pursuing similar initiatives in the near future.

At the same time, corporations have ramped up their focus on Bitcoin as an investment instrument. For instance, MicroStrategy has maintained its BTC buying strategy, demonstrating increasing confidence in the asset. Additionally, Bitcoin miners such as MARA, Hut 8, and others have also accumulated significant amounts of BTC. Despite these positive moves, the recent outflows from BlackRock Bitcoin ETF and other similar funds seem to have impacted investor sentiment.

What’s Next For BTC?

The recent outflows from BlackRock Bitcoin ETF and other similar funds have sparked speculations about the future of the investment instrument. This trend also suggests that institutional interest in digital assets may be waning.

However, it seems that the recent selloff was largely driven by the US Federal Reserve’s hawkish comments regarding their upcoming rate-cut plans. To provide context, the US Fed announced a 25 bps rate cut this month, while signaling further hawkish actions in their future rate adjustments.

Given these factors, the broader financial sector has also experienced a decline, not just the crypto market. However, despite the short-term pullback, experts remain confident in the long-term outlook for Bitcoin and the US Spot Bitcoin ETF.

Today, Bitcoin price surged nearly 5%, reaching $98,431 after hitting a low of $92,175 in the past 24 hours. Despite this upward movement, CoinGlass data revealed that Bitcoin Futures Open Interest remained near the flatline, suggesting that investors have yet to fully enter the market.