Ethereum Hits 4 Year Highs Amid Crypto Rally, Analyst Predicts Surge to $5,240

Highlights

- Spot Ethereum ETFs saw $500 million in net inflows on Tuesday, with BlackRock’s ETHA leading the charge.

- Ethereum (ETH) is spearheading the crypto market rally, posting 30% gains over the past week — the highest among the top 10 altcoins.

- Analysts predict Ethereum will continue to outperform other altcoins in a push toward new all-time highs.

Ethereum Leads Market Rally, Nears All-Time High

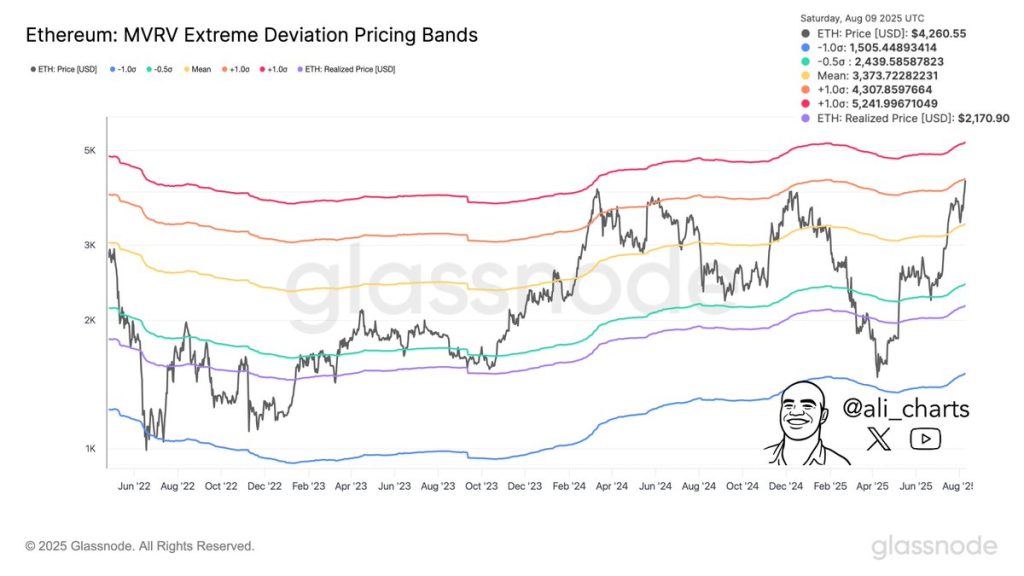

Ethereum (ETH) is once again at the forefront of the crypto market rally, posting an 8.5% gain in the past 24 hours and currently trading at a four-year high of $4,666. Now sitting less than 5% below its all-time high of $4,891, analysts are optimistic that ETH could soon break into new record territory, fueled by strong ETF inflows, a rising ETH treasury race, and broader market momentum.

Other major altcoins are also riding the wave. Solana (SOL) surged 12.9%, Dogecoin (DOGE) climbed 7%, Cardano (ADA) rose 10%, and Chainlink (LINK) jumped 12%, signaling widespread bullish sentiment across the crypto space.

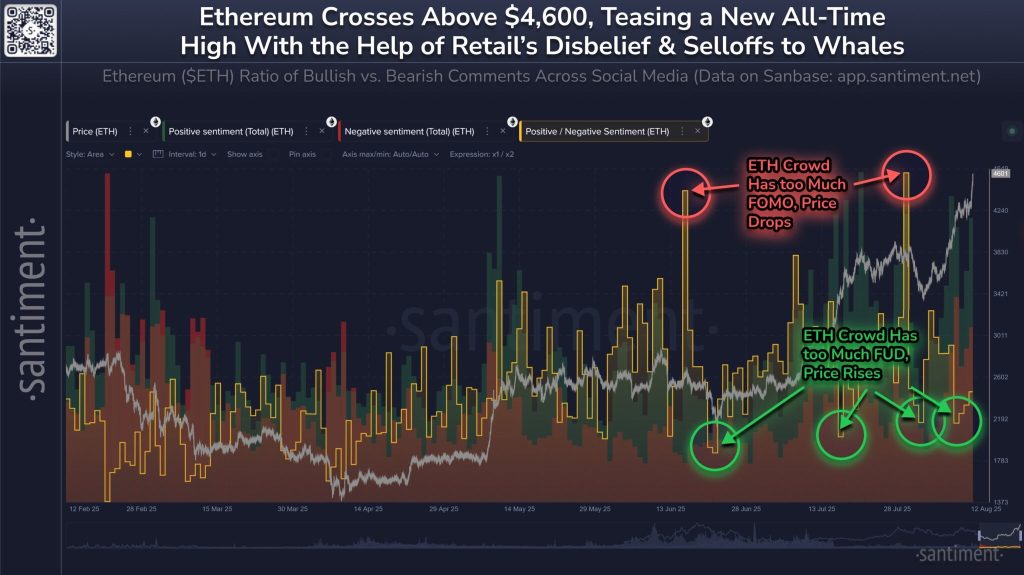

Retail Selling, Corporate Buying: Ethereum’s Contrarian Setup Intensifies

As Ethereum inches closer to its all-time high, retail traders continue to sell, according to data from blockchain analytics firm Santiment. Interestingly, this behavior aligns with a historical pattern — ETH price action often moves contrary to retail sentiment. Santiment highlighted that previous spikes in retail greed, specifically on June 16 and July 30, 2025, were followed by notable corrections.

In contrast, institutional and corporate players are aggressively accumulating ETH. On Tuesday, August 12, Ethereum treasury firm Bitmine Technologies announced plans for a $25 billion stock offering aimed at significantly increasing its ETH holdings. This wave of strategic accumulation is reducing resistance at higher price levels, potentially clearing the path for Ethereum to break through its previous all-time high of $4,891 and push even further.

Ether ETF Inflows Surge as Institutional Demand Accelerates

Spot Ether ETFs saw a renewed surge in demand on Tuesday, recording $500 million in net inflows, following the $1 billion milestone reached just a day earlier. BlackRock’s ETHA continues to lead the charge, surpassing $10.5 billion in assets under management, underscoring growing institutional interest in Ethereum.

On the same day, Ethereum’s daily issuance was just 2,428 ETH, while ETFs absorbed 127,403 ETH — meaning ETFs purchased over 52 times the newly issued supply. This significant supply-demand imbalance is adding bullish pressure to ETH’s price trajectory.

ETH Dominates as Analysts Call It an ‘Ethereum Season’

While Ethereum has rallied 30% over the past week, other major altcoins like XRP, Solana (SOL), Binance Coin (BNB), and Dogecoin (DOGE) have posted more modest gains ranging from 10% to 20%. This divergence suggests that the current market momentum is being driven more by Ethereum than by the broader altcoin market.

Popular crypto analyst Benjamin Cowen weighed in on the trend, suggesting that this is shaping up to be an “Ethereum season” rather than an altcoin season. He pointed out that the TOTAL 3 market cap — which excludes both BTC and ETH — is losing ground against ETH.

In a post on X, Cowen noted:

“ALTs are now down 50% against ETH since April. As I said below, this was ETH season, not ALT season. As long as ETH/BTC goes up, so too will ALT/BTC pairs. But ALT/ETH pairs will likely bleed for about 1-2 more weeks before they get a relief bounce.”

Cowen further noted that Ethereum is likely on track to break its previous all-time highs before experiencing a pullback in September. He added that altcoin-to-ETH pairs may start to recover once ETH/USD sets a new record high.