How Will Microstrategy Entering Nasdaq 100 Affect Bitcoin?

Summary

- MicroStrategy, now part of the Nasdaq 100 Index, holds $43B in BTC, marking a significant milestone for corporate Bitcoin adoption.

- Bitcoin’s price could reach $108.9k before the year ends, fueled by MicroStrategy’s actions and global adoption.

- Michael Saylor’s unwavering support and constant buying are boosting investor confidence.

MicroStrategy, the largest corporate holder of Bitcoin, now owns 423,650 bitcoins, according to its latest disclosure. The company has made waves in the financial world by becoming part of the prestigious Nasdaq 100 Index. This index tracks the top 100 largest non-financial companies, featuring global powerhouses such as Amazon, Apple, Nvidia, Meta, and others.

On November 29, 2024, a market snapshot revealed that MicroStrategy had reached a market cap of approximately $92 billion. This achievement propelled the company to the 40th spot on the Nasdaq 100, solidifying its position among some of the most significant firms in the world. MicroStrategy’s impressive market cap showcases its growing influence, driven in part by its substantial Bitcoin holdings.

The company’s inclusion in the Nasdaq 100 is a notable milestone in its journey under CEO Michael Saylor’s leadership. As the dominant corporate Bitcoin buyer, MicroStrategy continues to challenge traditional finance, positioning itself as a key player in both the tech and cryptocurrency spaces.

Will MicroStrategy’s Achievement Propel Bitcoin to a New ATH?

Michael Saylor actively supports Bitcoin and has committed to buying more, regardless of the price. He strongly believes in Bitcoin’s potential, initially aiming for it to hit the $100k mark and eventually reach millions in the coming years. MicroStrategy, under his leadership, now holds 234,650 BTC, valued at $43 billion. This substantial Bitcoin portfolio not only strengthens the company’s position but also boosts investor confidence, which could drive further price growth for the token.

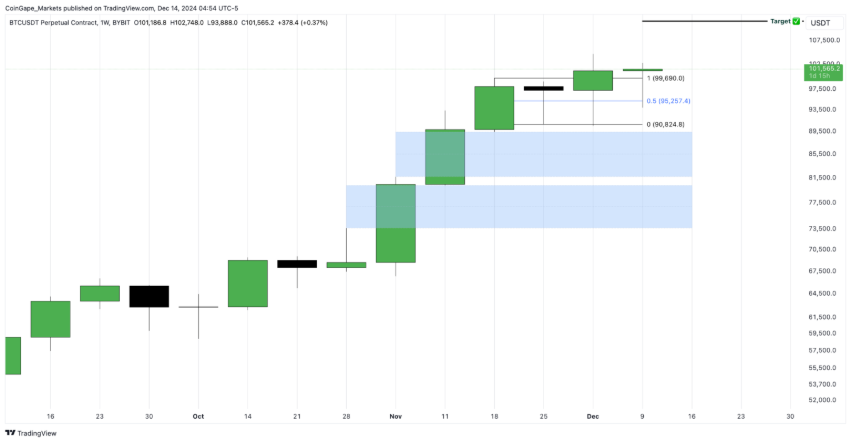

As of the latest report, Bitcoin is priced at $101.5k, just 2% below its all-time high of $103.9k. While this difference is minor, the token has struggled to reach its previous peak for several days. However, attention now turns to Michael Saylor’s inclusion in the Nasdaq 100, which could have a positive impact on Bitcoin’s price. In fact, following this news, Bitcoin experienced a slight recovery, rising to $102.5k earlier in the day, marking the biggest bounce since its previous ATH. Additionally, strong buying pressure continues to support the token.

With strong buying pressure, growing adoption, discussions of Bitcoin reserves in various regions, Donald Trump’s inauguration, and several other factors—including MicroStrategy’s recent achievement—Bitcoin is set to close the year on a positive note. More notably, Bitcoin’s price could reach $108.9K by the end of the year and continue climbing in 2025.