Kevin Hassett Opens Door to Fed Chair Role with Markets Seeing 87% Odds of a Third Rate Cut

Kevin Hassett Opens Door to Fed Chair Role with Markets Seeing 87% Odds of a Third Rate Cut

Kevin Hassett Opens Door to Fed Chair Role as Markets Boost Odds of Rapid Rate Cuts

White House economic adviser Kevin Hassett has publicly signaled that he is willing to serve as the next chair of the Federal Reserve if selected by President Donald Trump—an admission that has intensified speculation around the future leadership of the U.S. central bank at a moment of heightened monetary uncertainty. His comments come as financial markets increasingly price in accelerated interest-rate cuts, with traders consolidating around expectations that the Federal Reserve will adopt a much more aggressive easing stance to support a cooling U.S. economy.

Hassett’s remarks, delivered during a televised appearance, have drawn outsized attention because they align closely with investor hopes for softer monetary policy. This alignment has made his candidacy particularly noteworthy as prediction markets surge with confidence that the Fed is preparing to deliver three rate cuts this year, with odds hitting 87%, the highest level seen for that scenario.

Hassett Signals Willingness to Take Fed Chair Role Amid Rising Calls for Easing

Speaking on Fox and Friends, Hassett stated that he would be “happy to serve” if tapped to lead the Federal Reserve following Jerome Powell’s departure next year. While he has remained largely noncommittal in the past when asked about the top job, this latest statement represents his clearest and most direct indication yet that he is prepared to accept the nomination.

His willingness comes at a pivotal moment. Investors have grown increasingly convinced that the central bank will need to act decisively to counter weakening economic indicators, including slowing hiring, inconsistent consumer demand, and fragile manufacturing output. These pressures, combined with rising political scrutiny during an election cycle, have sharply raised expectations for a more accommodative monetary stance.

The timing of Hassett’s statement therefore carries weight: it underscores a policy outlook that markets believe the next Fed chair must embrace. With traders already leaning toward the view that the Fed will cut rates more rapidly, Hassett’s pro-easing perspective appears to reinforce that narrative.

Prediction Markets Hit 87% Confidence in Three Rate Cuts

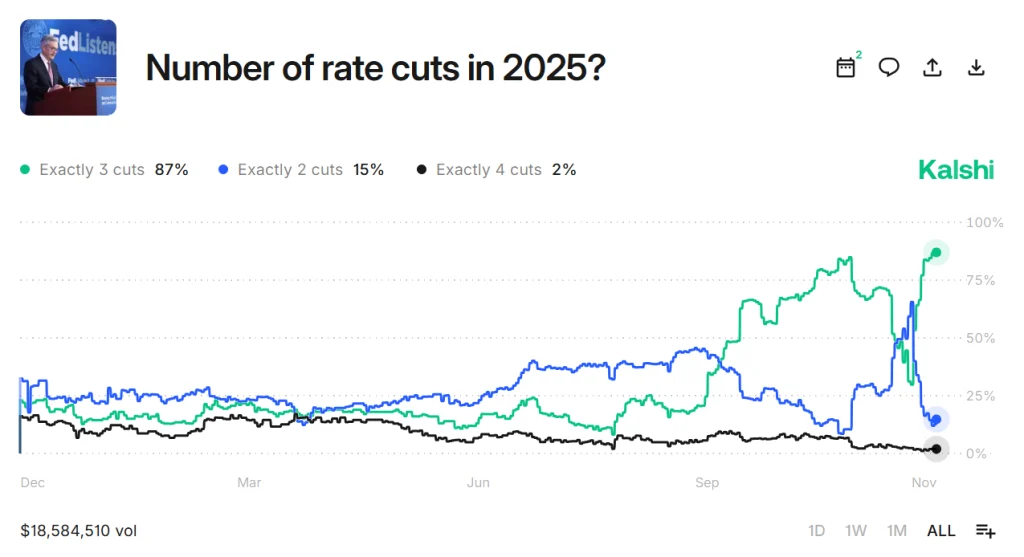

The growing conviction about the Fed’s path is most visible in event-based prediction markets, which have become an increasingly popular tool for measuring real-time investor sentiment. A widely circulated chart from Kalshi—shared on X (formerly Twitter)—shows an 87% probability that the Federal Reserve will deliver exactly three rate cuts this year. This marks a new high and reflects the strongest level of consensus among traders in recent months.

The Kalshi chart reveals that markets are shifting away from “wait and see” attitudes and are instead coalescing around a firm expectation of decisive monetary easing. For risk assets, this kind of clarity has already proven significant. Bitcoin and other cryptocurrencies have responded positively to the growing likelihood of rate cuts, benefiting from the broader bullish sentiment that typically accompanies expectations of increased liquidity.

The rising confidence in the Fed’s direction comes as core inflation begins to moderate. Yet the economy still faces mixed signals, leading many investors to place greater emphasis on forward-looking indicators such as central bank communication, political statements, and early clues about future leadership.

Hassett Rises to Front-Runner in Fed Chair Betting Markets

Alongside the surge in rate-cut expectations, another prediction market has spotlighted Kevin Hassett’s rapid ascent as the top contender to become the next Federal Reserve chair. According to Kalshi, which tracks public betting on political and economic outcomes, Hassett now holds 55% odds, making him the leading candidate in the race.

This development was amplified in an X post from Kalshi, which stated:

— Kalshi (@Kalshi) November 30, 2025

“BREAKING: Kevin Hassett is now the clear favorite for the next Fed Chair at 55% odds.

He’s known for:

• Pushing for faster rate cuts

• Alignment with Trump admin

• A macro view seen as bullish for stocks/crypto.”

The post also included a chart showing a sharp spike in Hassett’s odds over the past two trading sessions—an indication that market participants are increasingly confident he will be selected to lead the Fed.

Trailing him in the rankings are:

- Christopher Waller at 22%, known for his cautious but data-driven approach;

- Kevin Warsh at 12%, a former Fed governor with a more hawkish reputation.

The sudden surge in Hassett’s odds suggests that traders believe his appointment would more closely align with the administration’s priorities and with investor desires for quicker, more aggressive rate cuts.

Why Markets Favor Hassett: Growth-Focused Philosophy and Political Alignment

Hassett’s economic philosophy has long emphasized the benefits of stimulating growth through proactive interest-rate reductions. His approach is rooted in the belief that lowering borrowing costs can serve as an important safeguard during times of slowing economic momentum. Investors see this as a stark contrast to the more tempered strategies preferred by some current Federal Reserve officials who remain wary of easing too quickly.

Because of this, traders perceive Hassett as the candidate most likely to guide the central bank toward a policy path featuring earlier and more frequent rate cuts. His alignment with the Trump administration—another point highlighted in the Kalshi X post—further reinforces expectations that he would uphold a policy framework supportive of rapid economic expansion.

For markets that have become accustomed to reading political cues alongside economic data, Hassett represents a continuation of the administration’s long-standing emphasis on growth, corporate investment, and maintaining favorable financial conditions.

Potential Implications: What a Hassett-Led Fed Could Look Like

Should President Trump nominate Kevin Hassett and the Senate approve him, the resulting shift in leadership would come at a transformative moment for U.S. monetary policy. Inflation is easing from the peaks seen earlier in the decade, but the broader economy is still navigating uncertain terrain. Growth remains uneven across sectors, with manufacturing and small business sentiment showing strain even as service industries continue to demonstrate resilience.

A Hassett-led Federal Reserve would likely adopt a forward-leaning strategy aimed at preventing the economy from sliding into a slowdown. Depending on how aggressively he chooses to move, such an approach could deliver multiple benefits:

- Lower borrowing costs for businesses and households

- Increased liquidity throughout financial markets

- Potential boosts to equities and cryptocurrencies

- Support for investment and hiring

However, critics caution that a more aggressive easing framework could introduce risks. Too much liquidity too quickly may reignite inflationary pressures or fuel speculative excesses in certain asset classes. Given the Fed’s dual mandate—price stability and maximum employment—careful calibration will be essential.

Nevertheless, under a Hassett-led Fed, markets are likely to anticipate clearer communication, pro-growth rhetoric, and a commitment to preventing economic deceleration. His presence would likely reinforce expectations that the central bank will act swiftly in response to negative data surprises, providing a more predictable environment for traders and businesses.

Political and Market Ramifications Merge as 2025 Approaches

The Fed chair selection process is always politically significant, but this cycle carries added weight. With an election underway, monetary policy has become a central theme in public debate. The direction of interest rates will shape not only economic performance but also perceptions of economic management during a potentially volatile political year.

Kevin Hassett’s rising prominence places him squarely at the intersection of these political and financial forces. His open acknowledgment that he would accept the job, combined with his strong showing in prediction markets and the momentum generated by discussions on platforms like X, has elevated him to one of the most influential positions in the economic conversation.

The coming months will determine whether the trends implied by prediction markets and investor sentiment ultimately materialize. But for now, Hassett’s name sits at the center of discussions about the Fed’s future leadership, the pace of rate cuts, and the broader trajectory of the U.S. economy.