Solana experiences a “dramatic increase” in institutional portfolio adoption, as reported by CoinShares

CoinShares has identified a notable uptick in hedge funds and wealth managers allocating to Solana compared to earlier this year.

According to CoinShares, institutional investors are expanding their exposure to alternative coins, including Solana (SOL), which has witnessed a significant surge in allocations from wealth managers and hedge funds.

James Butterfill, CoinShares’ head of research, highlighted in a report dated April 24, based on a survey of 64 investors managing a combined $600 billion in assets, that investors are displaying increased optimism towards Solana.

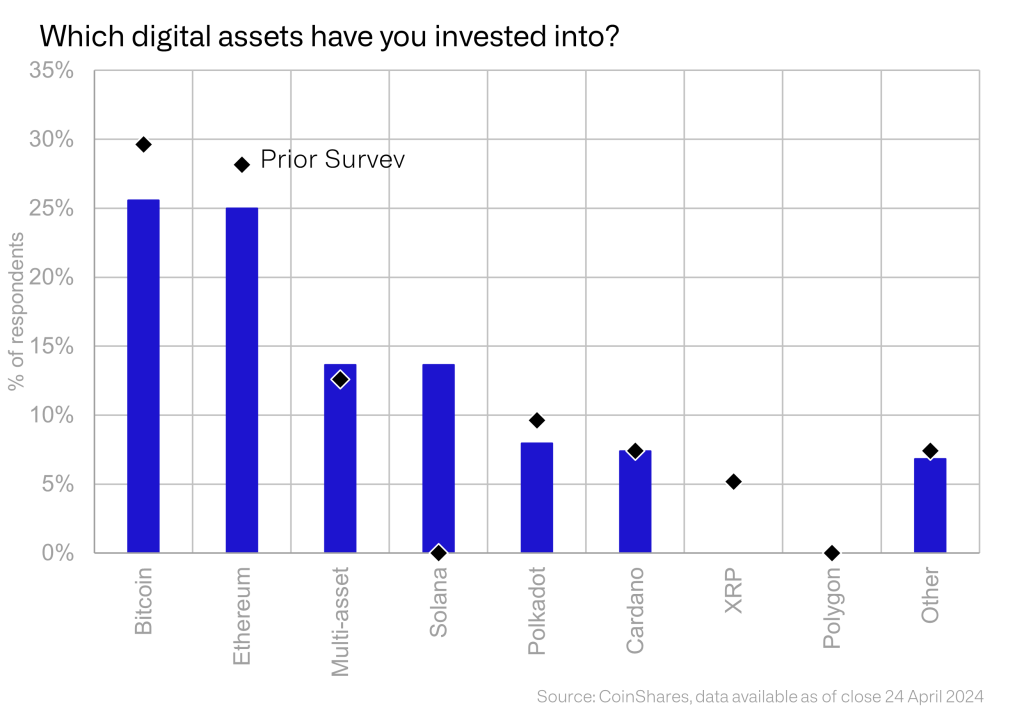

The report reveals that nearly 15% of surveyed investors have invested in SOL, a substantial increase from CoinShares’ January survey where none of the respondents had any holdings in the altcoin.

However, XRP (XRP) experienced a notable decline, with none of the survey participants currently holding it, in contrast to the January survey.

Despite the absence of XRP holdings among surveyed institutions, there are still allocations to investment products for the cryptocurrency, with CoinShares’ report indicating minor inflows of $1.3 million to XRP products for the week ending April 19.

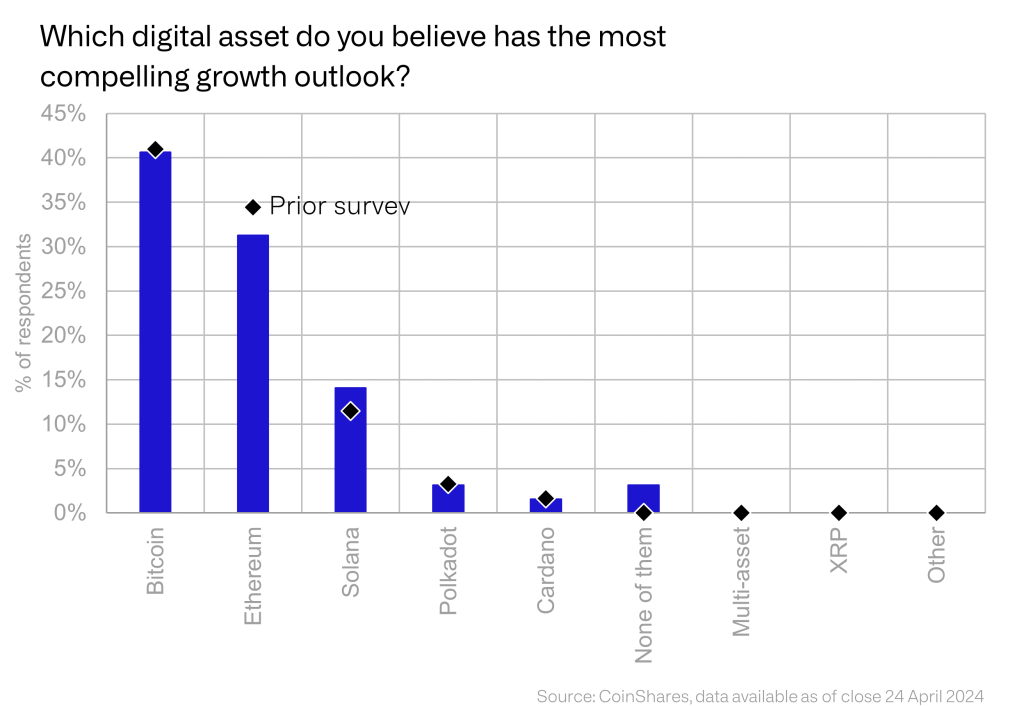

Solana ranked third in terms of the “most compelling growth outlook,” with just under 15% of respondents expressing agreement, marking a rise from over 10% in the January survey.

Bitcoin (BTC) retained its position as the preferred choice for investors, with 41% believing it offers the best growth potential.

Ether (ETH) secured the second position, with slightly over 30% of respondents bullish on its growth. Butterfill observed a decline in investor appetite for ETH since January, with its score dropping from around 35%.

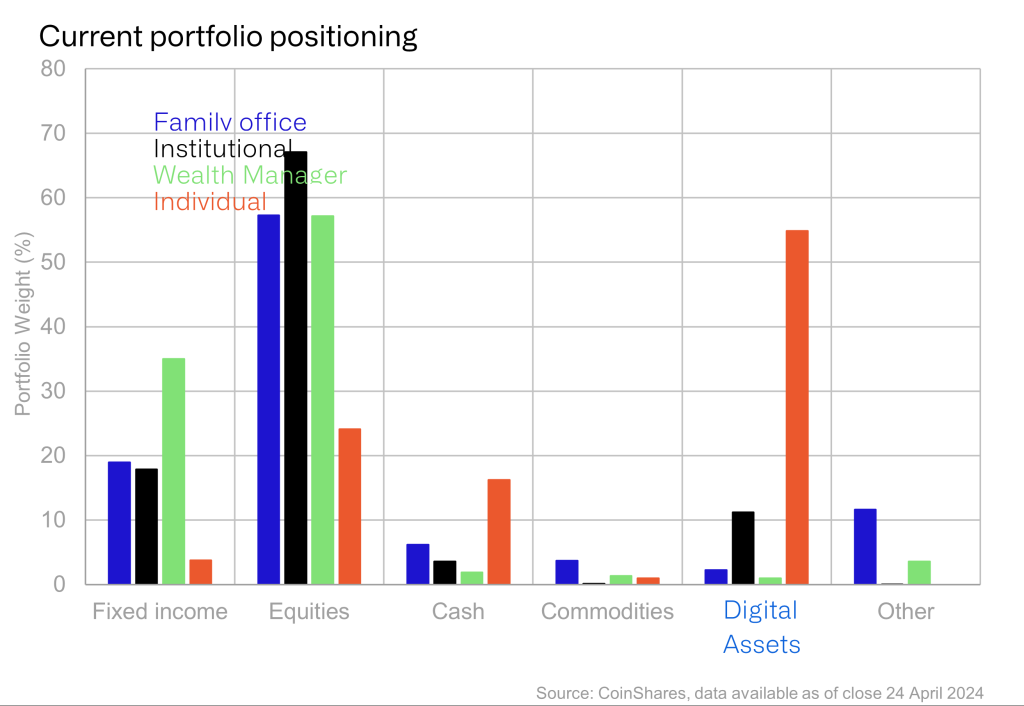

The survey also noted a rise in the percentage of cryptocurrency in investors’ portfolios, increasing to 3% compared to 1.3% in January, marking the highest weighting since the survey’s inception in 2021.

Notably, institutional investors contributed significantly to this increase, seizing the opportunity to gain exposure to Bitcoin through U.S. ETFs.

Equities remained the most heavily weighted asset class, comprising over 55% of portfolios.

Investors cited exposure to distributed ledger technology as the primary reason for purchasing digital assets. Despite the overall rise in cryptocurrency prices since January, the percentage of investors considering them “good value” surged from under 15% to over 20%.

However, while the data generally reflects a positive trend toward crypto, wealth managers and institutional investors highlighted significant barriers to entry into the asset class.

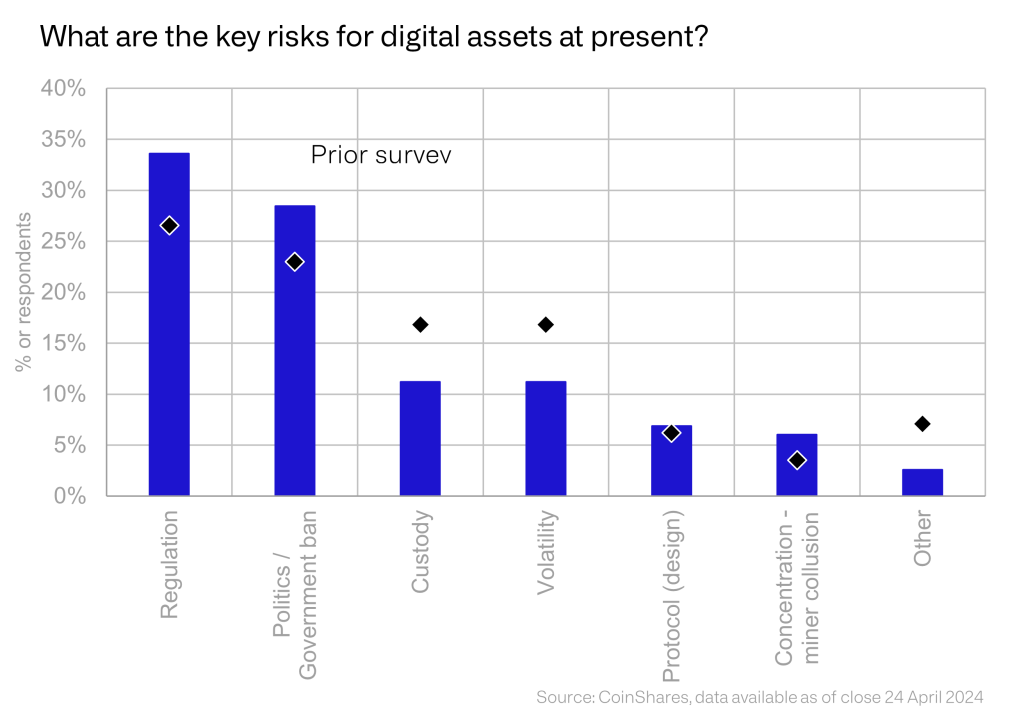

Regulation emerged as a major obstacle preventing investors from entering the crypto market, particularly for those who have yet to include crypto in their portfolios.

Moreover, investors with crypto holdings identified regulations and politics as the top perceived risks, signaling a notable increase from the January survey.

Butterfill noted that it is encouraging to see volatility and custody concerns diminishing over time.