Tether generates another $1 billion, reminiscent of its previous contribution to Bitcoin’s rise to $73K

Bitcoin has transformed its former resistance into support, while Tether’s market cap shows rapid growth in 2024.

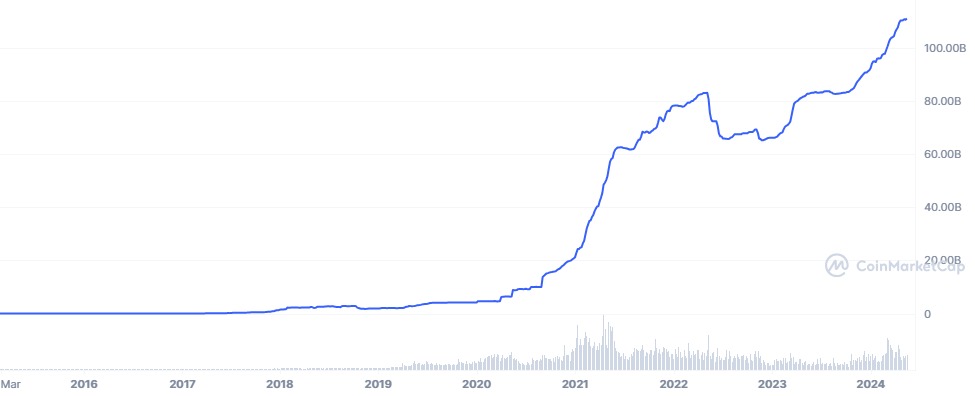

Tether (USDT), the world’s foremost stablecoin, has minted an additional $1 billion, propelling its market capitalization beyond $110 billion, potentially igniting Bitcoin’s (BTC) ascent to fresh all-time highs.

The question arises: will the injection of more USD Tether bolster Bitcoin’s value? Tether’s Treasury has churned out $1 billion worth of USDT within the last 24 hours, adding to its yearly total of $31 billion.

Historically, the influx of newly minted USDT has played a significant role in driving Bitcoin’s price surge, as evidenced by its climb from $27,000 to $73,000. A May 17 report from Lookonchain underscores this correlation.

Moreover, Tether’s commitment to diversifying the stablecoin’s backing assets by allocating 15% of its net profit into Bitcoin could further fuel Bitcoin’s rally. The acquisition of 8,888 Bitcoin valued at $618 million on March 31 catapulted Tether into the ranks of the world’s seventh-largest Bitcoin holder, with its wallet currently housing over 78,317 BTC, worth in excess of $5.18 billion—a year after announcing its strategic shift towards Bitcoin.

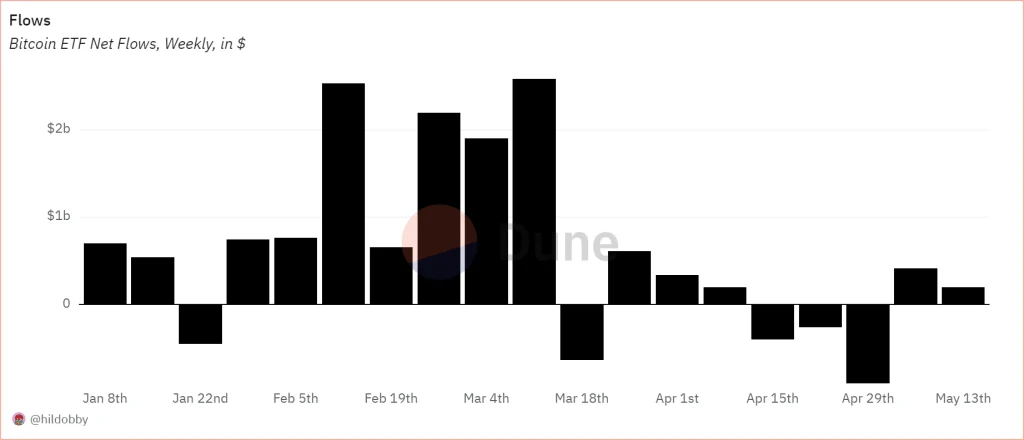

Yet, Bitcoin’s price trajectory remains heavily reliant on institutional inflows into spot Bitcoin exchange-traded funds (ETFs). Notably, the United States Bitcoin ETFs witnessed their second consecutive week of net positive inflows, accumulating over $200 million in cumulative net flows, according to data from Dune.

Institutional inflows through ETFs have been instrumental in driving Bitcoin’s recent rally to unprecedented highs. As of February 15, Bitcoin ETFs accounted for approximately 75% of new investments in the world’s leading cryptocurrency, surpassing the $50,000 milestone.

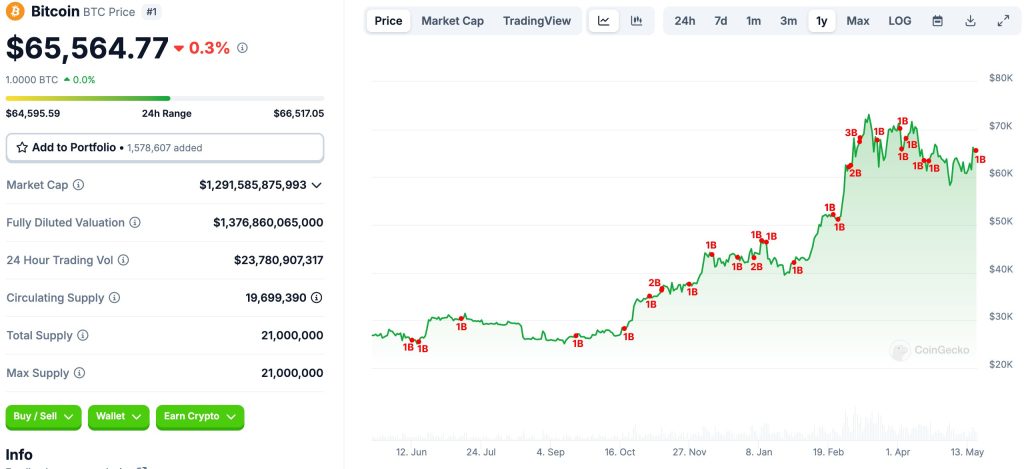

Bitcoin’s recent price action has confirmed a breakout on the daily chart, with the $65,000 level emerging as robust support for BTC. Furthermore, on the monthly chart, Bitcoin has successfully transformed its former resistance into a formidable support level, as noted by a May 16 analysis from prominent crypto analyst Rekt Capital.

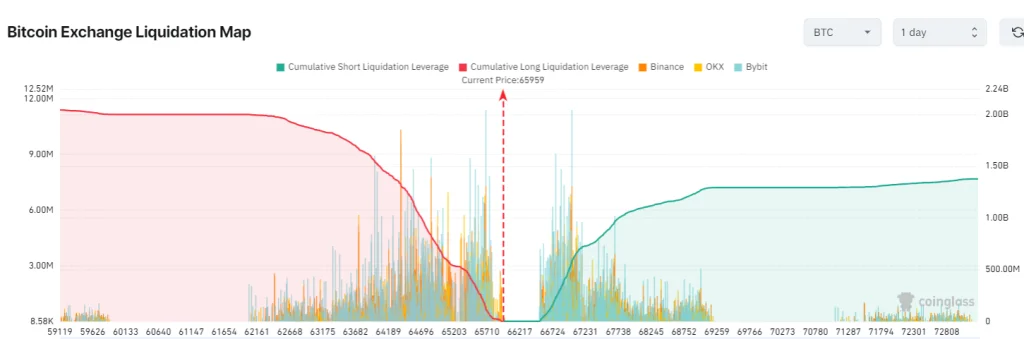

However, a temporary correction to below $63,500 could be on the horizon before Bitcoin reclaims the psychologically significant $70,000 threshold, according to insights derived from an artificial intelligence-based predictions algorithm by ScorehoodAI. Such a pullback would serve to liquidate high-leverage positions, contributing to market health.

In the event of a potential correction to below $63,500, Coinglass data suggests that over $1.76 billion worth of leveraged long positions could be liquidated, with liquidations reaching $1.87 billion below the $63,000 mark.

Disclaimer: The content provided in this article is solely for informational and educational purposes.

Crypto News Online Hub assumes no liability for any losses arising from the use of information,

products, or services referenced herein. Readers are urged to proceed with caution and conduct

thorough research before making any decisions related to the subject matter discussed.