Solana sheds light on the shadowy aspects of monolithic blockchain systems

The discourse on blockchain scalability revolves around the debate between “modular” and “monolithic” approaches, each carrying its own set of advantages and drawbacks.

In the modular corner, proponents advocate for tiered systems like Ethereum’s, where smaller transactions are offloaded to layer-2 and layer-3 solutions before settling on the base chain. While this strategy fosters scalability, it also introduces network fragmentation and compromises user experience.

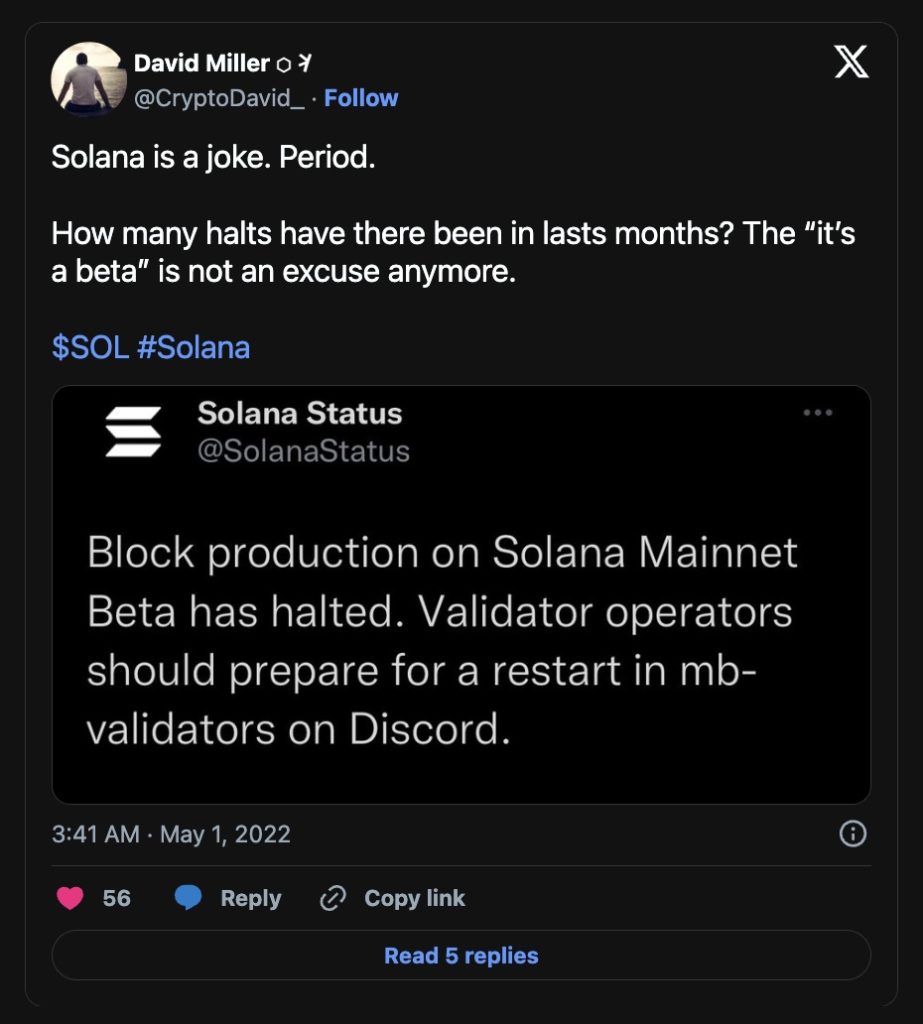

Conversely, the monolithic strategy championed by Solana focuses on optimizing a single chain to accommodate all transactions through hardware, software, and consensus enhancements, ensuring a smoother user experience. However, this approach risks sacrificing decentralization and resilience, essential qualities of blockchain.

A fundamental misunderstanding often arises among supporters of the monolithic approach regarding the primary service of permissionless chains. Rather than merely processing transactions, decentralized networks offer secure blockspace—a limited and valuable asset. Like any scarce resource, its allocation is determined by price, with higher prices curbing demand and promoting efficiency.

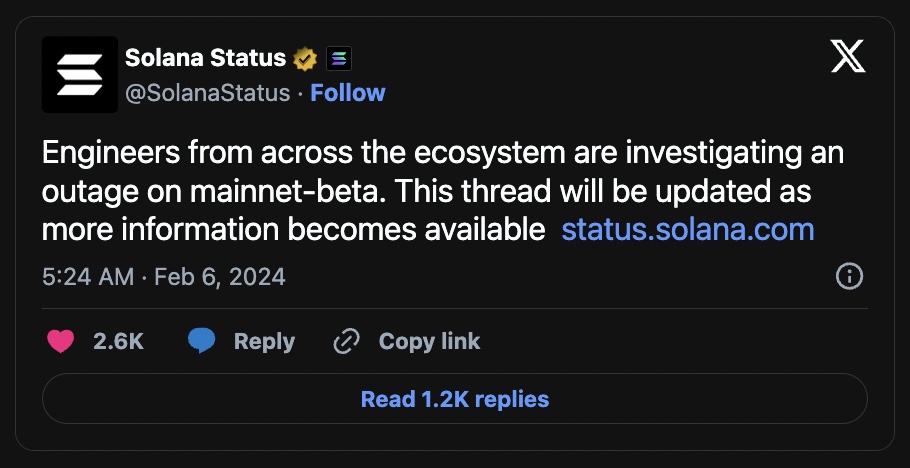

In the case of Solana, recent spikes in demand during the memecoin craze resulted in high transaction failure rates, exacerbated by users repeatedly attempting transactions. This scenario mirrors the consequences of underpricing secure blockspace.

Modular chains, on the other hand, offer varying tiers of secure block space at different prices, tailoring to the needs and capabilities of different users. However, Solana seeks to provide equal security for all transactions, regardless of value, which is akin to offering unnecessary security to trivial transactions.

While Solana developers are exploring upgrades to improve fee markets and scalability, these efforts risk pricing out smaller traders during peak times. Moreover, scaling through software and hardware enhancements may inadvertently increase demand for small value transfers, undermining the stability and decentralization of the network.

In essence, while the intentions behind monolithic scaling are commendable, the resulting outcomes may compromise decentralization and resilience, ultimately challenging the fundamental principles of blockchain technology.