The daily inflow for BlackRock’s Bitcoin ETF reaches $0 for the first time

Introduction: BlackRock’s Bitcoin ETF, the iShares Bitcoin Trust (IBIT), has been a significant player in the cryptocurrency investment space since its launch in January. However, its streak of daily inflows came to a halt on April 24, marking the first day of zero inflows since the introduction of Bitcoin exchange-traded funds in the United States. This article explores the implications of this event and provides insights into the broader landscape of Bitcoin ETFs in the U.S.

The Rise of IBIT: Since its inception on January 11, IBIT has been a magnet for investment, consistently attracting millions of dollars daily. In just 71 days, it accumulated an impressive $15.5 billion in inflows, establishing itself as a dominant force in the Bitcoin ETF market.

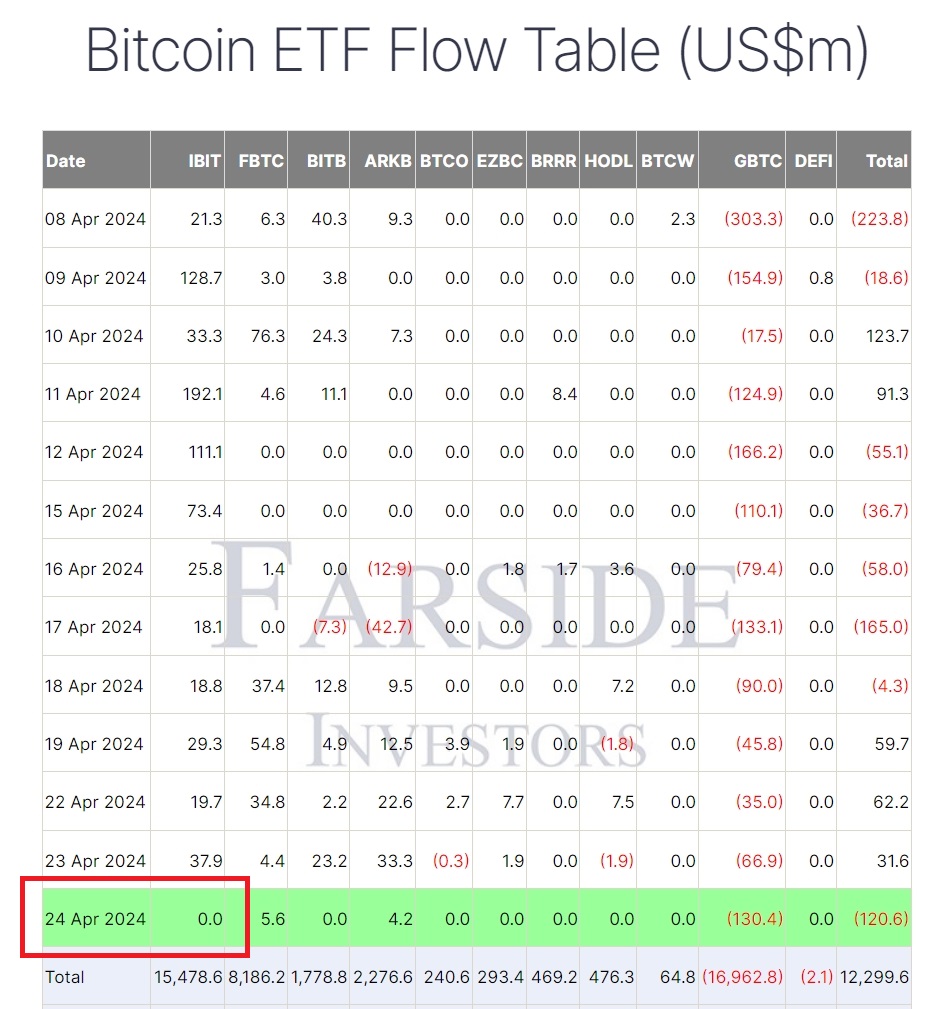

The End of the Inflow Streak: On April 24, the streak of daily inflows for IBIT came to an abrupt halt as it recorded zero inflows for the first time. This unexpected event raised eyebrows and sparked discussions about the stability and sustainability of Bitcoin ETF investments.

Dry Spell Across the Board: IBIT was not the only Bitcoin ETF experiencing a dry spell on April 24. Among the 11 U.S.-registered Bitcoin ETFs, only Fidelity Wise Origin Bitcoin Fund (FBTC) and ARK 21Shares Bitcoin ETF (ARKB) managed to record inflows, while others saw stagnation or outflows.

The Case of Grayscale Bitcoin Trust ETF (GBTC): One notable player in the Bitcoin ETF market, Grayscale Bitcoin Trust ETF (GBTC), continued to struggle with outflows. On April 24 alone, GBTC recorded significant outflows, contributing to a net outflow of $120.6 million for spot Bitcoin ETFs.

Challenges and Opportunities: While the lack of inflows is a new development for IBIT, it is not uncommon among other ETF participants. Fidelity’s FBTC, for instance, has experienced multiple days of zero inflows in recent weeks. This raises questions about investor sentiment and market dynamics in the cryptocurrency space.

The State of the Bitcoin ETF Market: Despite the challenges faced by individual ETFs, the overall Bitcoin ETF market in the U.S. has seen substantial growth, accumulating a net inflow of $12.3 billion in Bitcoin since January. However, the outflows from GBTC have partially offset the gains made by other ETFs, highlighting the need for diversification and risk management.

Exploring Ether (ETH) ETFs: In addition to Bitcoin, some market participants are exploring the possibility of introducing Ether (ETH) ETFs in the United States. However, the Securities and Exchange Commission (SEC) recently delayed approval decisions for several ETH ETF proposals, citing the need for additional time to review the proposed rule changes.

The Road Ahead: As the cryptocurrency market continues to evolve, the future of Bitcoin and Ether ETFs remains uncertain. While the recent halt in inflows for IBIT may raise concerns, it also presents an opportunity for market participants to reassess their strategies and adapt to changing conditions. With regulatory developments and investor sentiment playing crucial roles, the coming months will be pivotal for the future of ETFs in the cryptocurrency space.

Conclusion: The end of BlackRock’s Bitcoin ETF inflow streak on April 24 marks a significant moment in the evolving landscape of cryptocurrency investments. While challenges persist, the resilience and growth of the Bitcoin ETF market demonstrate the continued interest and potential for innovation in this space. As investors navigate the uncertainties ahead, staying informed and proactive will be key to unlocking opportunities and mitigating risks in the dynamic world of digital assets.