Grayscale observes a double halving as its Bitcoin holdings drop to 310k

Grayscale’s Bitcoin Trust (GBTC) has seen a dramatic decline in assets, plummeting from 640,000 BTC to approximately 308,000 BTC in less than four months. This decline is attributed to ongoing fees, which are dissuading investors.

The steady outflows from Grayscale’s Bitcoin ETF have resulted in its holdings halving since the trust’s transition to a spot Bitcoin ETF. Without a surge in new investments, both its assets and Bitcoin block rewards will halve this week.

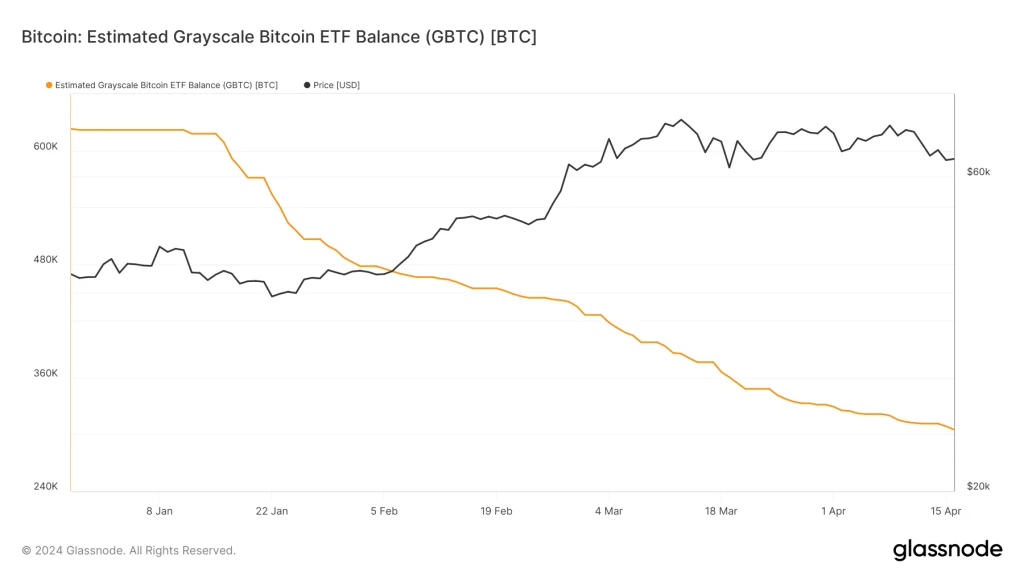

At the time of the approval of spot Bitcoin ETFs in January, Grayscale managed around 640,000 BTC. Presently, it holds roughly 308,000 BTC, valued at approximately $19.7 billion.

Although the quantity of Bitcoin managed has dropped by 51%, the reduction in assets under management is only 29%, thanks to Bitcoin’s price increase from $42,000 to $63,000.

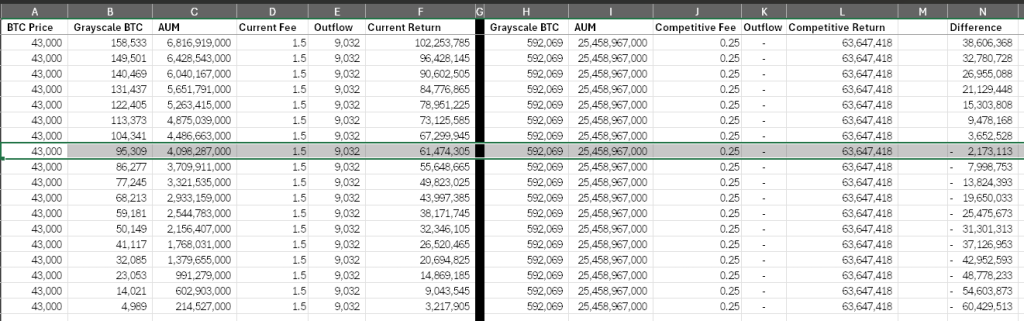

The primary reason for the outflows, compared to competing ETFs, is believed to be Grayscale’s disproportionately high fees. While maintaining these fees has allowed Grayscale to maintain higher revenues, it is nearing a point where reducing fees may become necessary.

An analysis conducted in late January suggested that even with 95,000 BTC under management, Grayscale could still generate over $60 million annually in fees alone. This revenue would position it near the top of the industry in terms of revenue generation.