Worldcoin aims to raise the WLD supply by up to 19% in the next 6 months

The cryptocurrency ecosystem is no stranger to strategic maneuvers aimed at bolstering project growth and market presence. Recently, Worldcoin, a digital identity initiative, made headlines with its announcement of significant token sales to select trading firms outside the United States. In this comprehensive exploration, we dissect Worldcoin’s strategy, its potential impact on the market, and the broader implications for the digital identity landscape.

The Token Sale Initiative

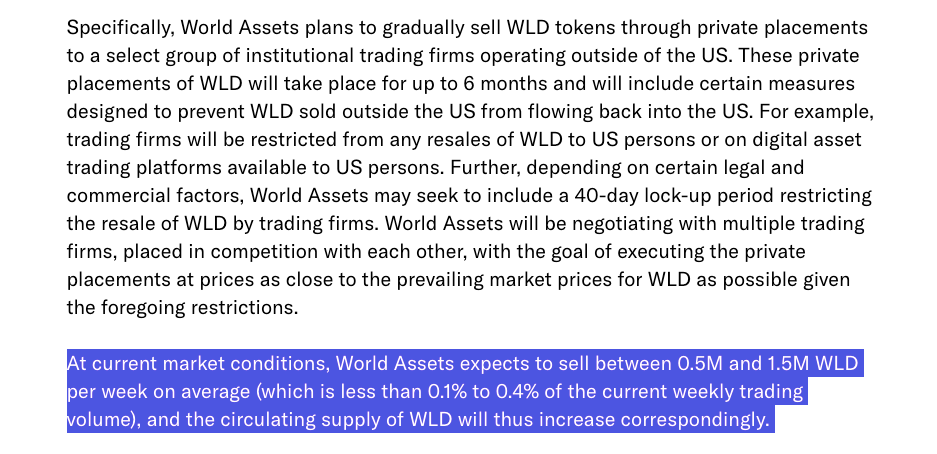

On April 23rd, Worldcoin unveiled its ambitious plan to increase the supply of its WLD token by up to 19% over the next six months through private sales to non-U.S. institutions. Spearheaded by World Assets, a subsidiary of the Worldcoin Foundation, these sales will see up to 1.5 million WLD tokens, valued at approximately $8.2 million, distributed weekly to institutional trading firms operating outside the United States.

Worldcoin emphasized that these private placements would range between 0.5 million and 1.5 million WLD per week on average, leading to a proportional increase in the circulating supply of WLD tokens. This initiative is projected to inject a staggering 36 million new tokens into the market, totaling around $197 million in value, as per CoinGecko data.

Implications for Market Dynamics

The influx of WLD tokens resulting from these private sales is poised to have significant repercussions on market dynamics. With a current circulating supply of 193 million WLD tokens, the planned increase represents an 18.6% expansion within the same time frame. Such a substantial augmentation has the potential to influence token liquidity, price stability, and investor sentiment within the Worldcoin ecosystem and beyond.

Worldcoin’s commitment to negotiating private placements at prevailing market prices aims to mitigate potential adverse effects on token value. By engaging with individual trading firms and optimizing placement execution, Worldcoin seeks to minimize disruption and ensure a harmonious integration of new tokens into the market.

Understanding Worldcoin: Vision and Evolution

Before delving deeper into the implications of the token sale initiative, it’s essential to grasp the foundational principles and evolution of Worldcoin. Launched out of beta in July 2023, Worldcoin was founded by prominent figures such as OpenAI CEO Sam Altman, current CEO Alex Blania, and Max Novendstern, CEO of biometrics research firm Mana.

Worldcoin distinguishes itself as a crypto-based digital identity project with a twofold mission: addressing identity challenges stemming from rapid advancements in AI and pioneering a novel universal basic income model through its native WLD token. Users register their identity via the “World App” by undergoing retinal scans at designated “Orbs” machines, receiving approximately 25 Worldcoin tokens in exchange for their biometric data.

Market Performance and Volatility

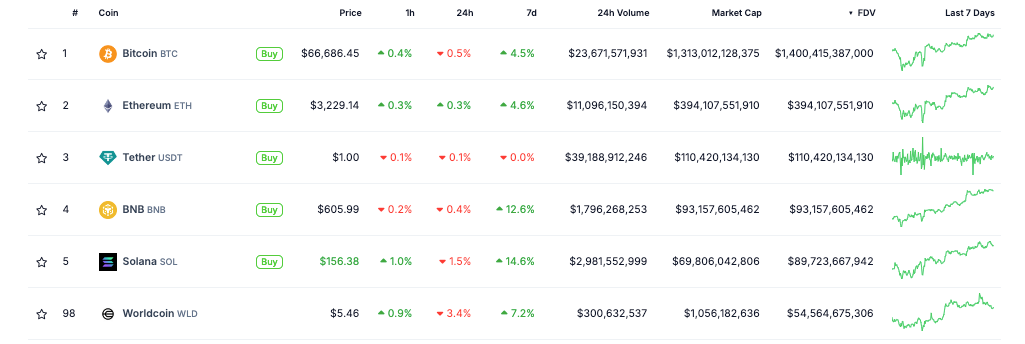

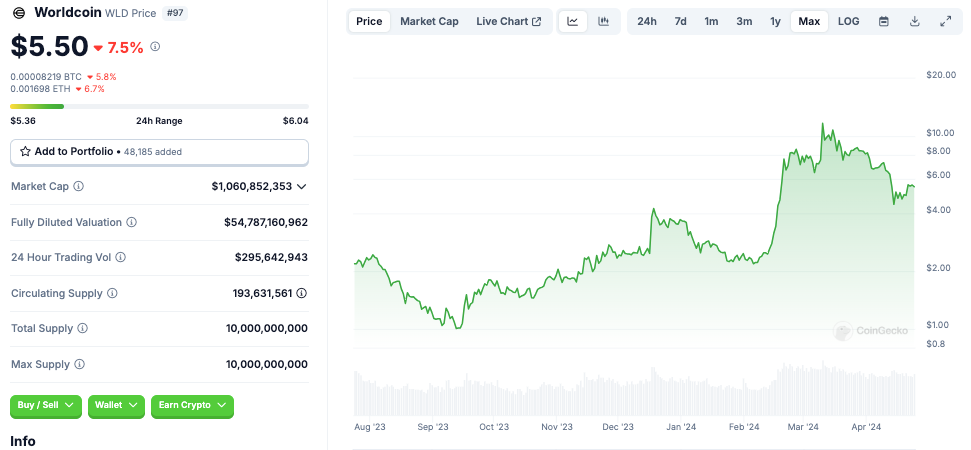

The trajectory of Worldcoin’s market performance serves as a barometer of its journey and resilience within the cryptocurrency space. Buoyed by broader rallies in AI-linked crypto projects, Worldcoin experienced a meteoric ascent, soaring 435% from its launch price of $2.17 on July 24 to a peak of $11.74 on March 10.

However, the project’s price has since experienced a significant correction, plummeting over 53% from its all-time high in recent weeks and currently hovering around $5.49. This volatility underscores the inherent challenges and fluctuations inherent in the cryptocurrency market, highlighting the importance of strategic initiatives such as the token sale in navigating market dynamics.

Conclusion: Navigating the Future Landscape

As Worldcoin embarks on its token sale journey, stakeholders and observers alike are poised to monitor its trajectory and impact on the broader cryptocurrency ecosystem. The strategic distribution of WLD tokens to non-U.S. institutions signifies a pivotal moment in Worldcoin’s evolution, marked by a commitment to expansion, liquidity, and market accessibility.

Navigating the future landscape will require a delicate balance between growth aspirations and market stability. By fostering transparency, collaboration, and innovation, Worldcoin has the potential to redefine digital identity solutions and contribute to the broader narrative of financial inclusivity and empowerment.

As the journey unfolds, all eyes remain on Worldcoin and its quest to shape the future of digital identity and cryptocurrency adoption. With strategic initiatives such as the token sale, Worldcoin reaffirms its position as a trailblazer in the ever-evolving landscape of blockchain technology and decentralized finance.