Ethereum Fees Hit Lowest Level Since January: Could This Signal a Bottom?

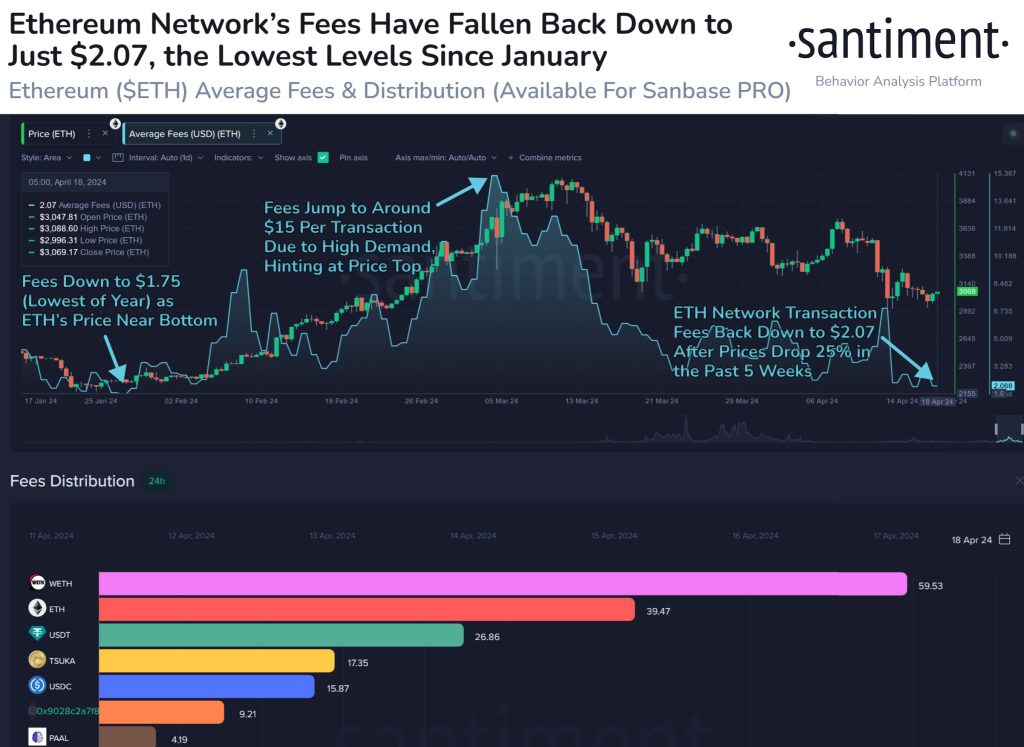

In the ever-evolving landscape of cryptocurrencies, Ethereum has recently seen a significant drop in transaction fees, signaling a potential shift in network activity and possibly the market sentiment itself. On-chain data analyzed by Santiment, a prominent analytics firm, shows that the average transaction fees on Ethereum have plummeted to their lowest point since January, hinting at underlying trends that could influence the future price trajectory of the cryptocurrency.

Understanding Ethereum’s Transaction Fees

Ethereum transaction fees, commonly known as gas fees, are payments made by users to compensate for the computational energy required to process and validate transactions on the Ethereum blockchain. These fees vary based on the network’s demand and the data complexity of the transactions. Essentially, the more congested the network, the higher the fees as users compete to prioritize their transactions.

Recent data indicates that these fees have dropped significantly, with the average cost dipping to around $2.07, the lowest since the beginning of the year. This decline in transaction fees can be primarily attributed to a decrease in network congestion and activity, suggesting that fewer users are transacting or engaging with decentralized applications on Ethereum at present.

Analyzing Network Activity and Market Implications

The correlation between network activity and transaction fees is straightforward: high activity leads to congestion, which in turn drives up the fees. Conversely, a drop in fees often signifies reduced activity, which can be interpreted in various ways. For one, it could indicate a cooling period where speculative trading and decentralized finance (DeFi) activities slow down. However, this does not necessarily spell bad news for Ethereum’s valuation.

Historical data from Santiment suggests that periods of low average fees often coincide with market bottoms, providing potential buying opportunities for investors. For instance, when Ethereum’s transaction fees last reached a low of $1.75 in January, it was closely followed by a significant price increase. Similarly, fee spikes, such as the $15 peak observed last month, typically align with market tops where the price subsequently faces downward pressure.

Ethereum’s Price Trends

Despite the recent dip in transaction fees and reduced network activity, Ethereum’s price dynamics offer a mixed picture. The cryptocurrency experienced a notable decline, falling below $2,900. However, it has since shown resilience, with recovery efforts pushing the price back to around $3,100. This price recovery amidst decreasing transaction fees adds an interesting layer to the typical correlation observed between network activity and price movements.

Forward-Looking Insights

The current state of Ethereum’s transaction fees and their implications for network activity present a complex scenario for traders and investors. The key question remains whether the low fees and reduced network activity are temporary lulls or indicative of a more prolonged period of decreased enthusiasm and participation in the Ethereum market.

Investors and market watchers would do well to keep an eye on further on-chain metrics and broader market indicators to better understand the potential direction of Ethereum’s price. Should the trend of low fees continue, it might suggest that now is an opportune time to consider entering the market, especially if the historical pattern of fee lows signaling price bottoms holds true.

In conclusion, while the drop in Ethereum’s transaction fees and the accompanying decrease in network activity may raise concerns at first glance, they could also represent a cyclical opportunity within the cryptocurrency market. As always, potential investors should consider not only these factors but also a wide range of economic, technological, and geopolitical influences when making investment decisions in the volatile realm of cryptocurrencies.